TL;DR

No, cryptocurrencies don't all use the same blockchain, there are more than 1,000 blockchains as of 2022

There are 4 blockchain types, which are different to blockchains themselves. These are public, private, consortium and hybrid (save that one for ya next pub quiz and you'll be a legend)

Blockchains are striving to solve the 'blockchain trilemma' and it's one large reason why so many are emerging

It's unlikely there will ever be one unified blockchain. Think about it, is there one universal smartphone? Is there just one social media? One video calling system?

Intro to the blockchain

We do have a separate piece explaining what this blocky tech is all about, but here's a quick intro nonetheless.

The blockchain system was first designed with Bitcoin in mind. Satoshi Nakamoto, the inventor of Bitcoin, wanted a decentralised way of recording payment transactions. They needed something which wasn't centralised like a bank, and so, they set their sites on this type of technology.

As Bitcoin grew in popularity, other cryptocurrencies began to emerge too. And with more cryptos, came more blockchains.

The purpose of a blockchain is to power 'De-Fi', which stands for decentralised finance. What the blockchain is to De-Fi, is what a bank is to our current financial system – it's the foundation.

How many blockchains are there?

The number is always growing thanks to Web 3's constant expansion, but as of 2022 there are over 1,000. That's because anyone can create one, much like anyone can create a cryptocurrency or NFT.

A good comparison to make is Google's Cloud system which is a centralised example of an online file storage system. Apps such as Gmail, Google Docs, Google Sheets are all built into it, allowing us to collaborate. When we talk about blockchains, some may have similarities to Google's Cloud, only the system would be decentralised, as would the apps (hence why we call them 'dapps').

Of course, not every blockchain will try to serve in the way Google's Cloud does; different chains will have different purposes (another reason as to why there are so many).

So why use a blockchain? Well, as great as Google is, it has all your data and this has become a sticking point with many people. It's not just Google too, it's every large company you can think of that we interact online with. What many people now want is the same type of online utility these companies offer, but with access to their own data.

One reason why new blockchains are being created so often is because there's a race to try to solve something called the blockchain trilemma. Sounds dramatic right? Well for more information on this check out our article on what is the blockchain? Explained in simple terms.

But for now, here are three popular examples of blockchains. 👇

Ethereum

The Ethereum blockchain is regarded as the most well-known after the Bitcoin blockchain. This is because creators of NFT projects and decentralised apps can build their projects on it, typically with smart contracts integrated.

For any Harry Potter fans out there, I like to think of smart contracts like the ‘‘The Unbreakable Vow’ spell in Harry Potter and the Half Blood Prince – only you don’t die if it’s not fulfilled.

The Ethereum network has already created a profitable and open economy, which is why a lot of new projects are drawn to it. In a world where everything is so new, it can be comforting knowing the blockchain you're building on is tried and tested (relatively speaking).

There are drawbacks to Ethereum though, and one of these is scalability. Due to its popularity, it has become very crowded and this slows the speed of transactions down. This is bad news as 'network' (or gas) fees go up, which the creators have to pay. It can become extremely expensive for a creator to build on the Ethereum blockchain.

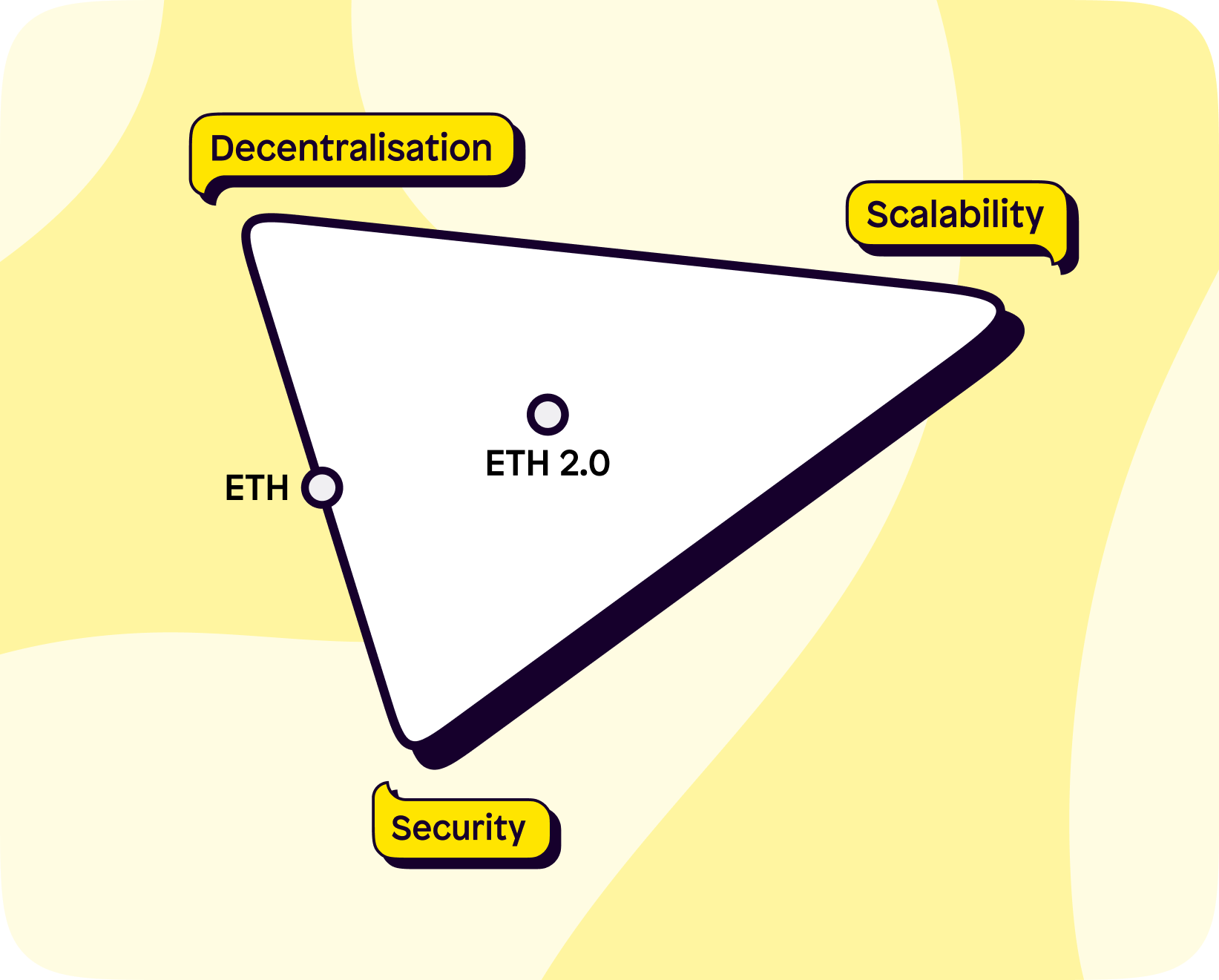

This has become one of the biggest criticisms of the network, but those who are loyal to Ethereum have big hopes for 'Ethereum 2.0' which is aiming to be a perfect blend between scalability, security and decentralisation.

Ethereum 2.0 has been experiencing delays though, which has allowed competitors to steal market share.

Solana

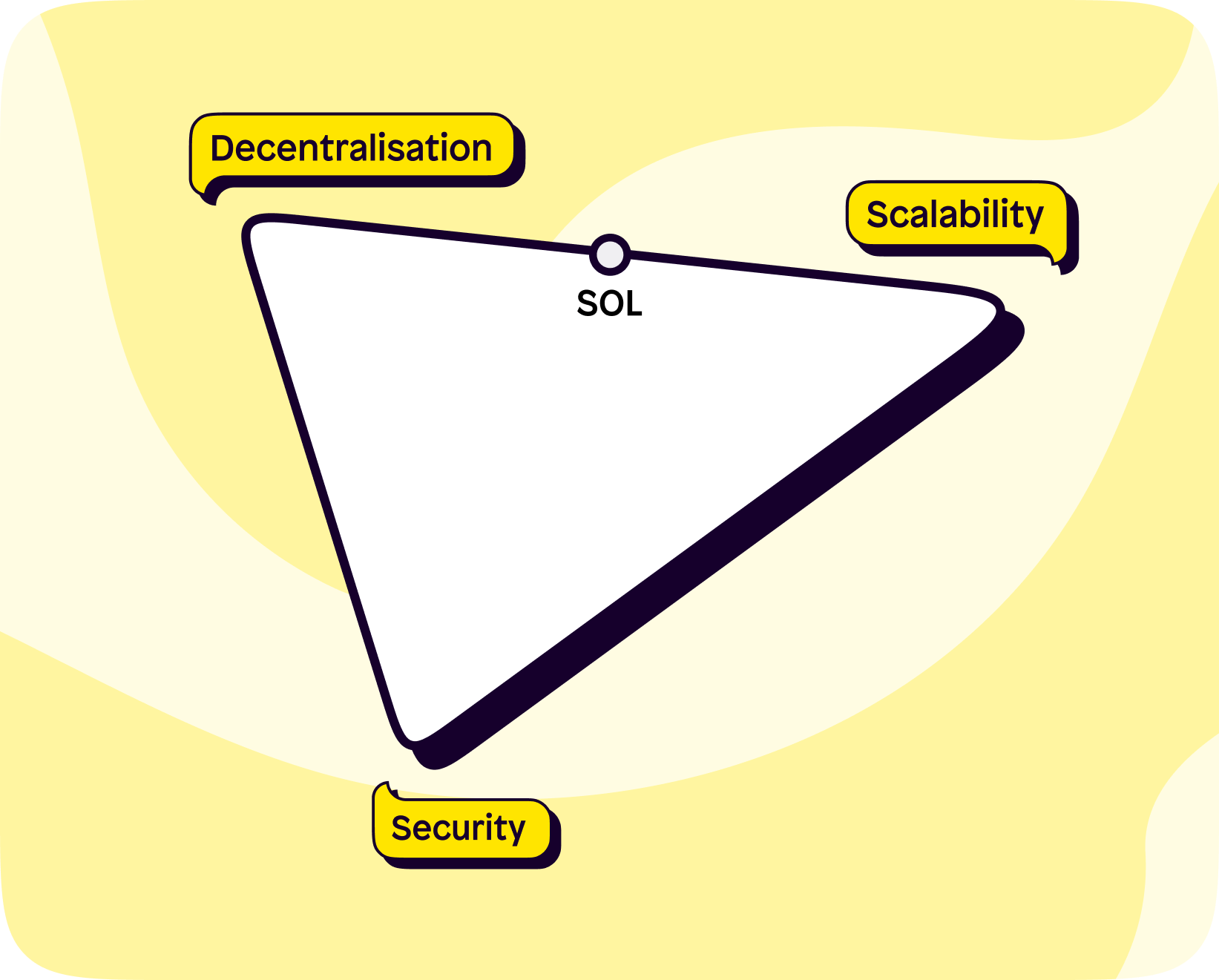

The Solana blockchain offers users high speed, meaning it's very scalable. Solana drew inspiration from the Nasdaq, which revolutionised the amount of trades that could be done in a second.

In fact, Solana has proven it can handle over 50,000 transactions per second, with potential of handling up to 710,000 per second.

Solana is able to do this using the ‘proof-of-history’ model which is why it’s so much quicker than competitors. As transactions happen quickly, network fees are kept pretty cheap. These cheaper fees are a large reason why many NFT creators favour the Solana network.

Speed does come with trade-offs, though. The levels of security and decentralisation are lower than on Ethereum’s network.

Also known as the Matic network, Polygon is a blockchain that supports Ethereum. Okay, this is getting confusing now.

Essentially, not all blockchains are in competition with one another. Some are designed to help power others, and in this case, that's exactly what Poly does for Ethereum.

You know we love an analogy around here, so think of this like a Chrome extension. Google Chrome is the browser and those who make Chrome extensions are simply making the experience better for the user.

Remember how we said Ethereum is very slow? Well, Poly has the potential advantage to speed transactions up.

Blockchain types

Although there are lots of different blockchains, there are only four different blockchain types. Think of the types as the skeletal structure.

1. Public

Anyone can join and they are completely decentralised thanks to being permissionless. They allow nodes to have equal rights to access the blockchain as well as create and validate blocks of information. (A node is simply a computer that helps maintain the blockchain by storing and validating transactions.)

Their main use is for exchanging and mining crypto. Bitcoin and Ethereum are examples as these coins can be mined when users help keep the blockchain intact. It's this aspect that aims to cut out the middleman (i.e, a banker) as miners would be the network validating a transaction, not a central body like a bank.

2. Private

As the name might suggest, these are permissioned blockchains that are controlled by a single organisation. The central body decides who can be a node. Nodes don't have equal rights either. Ripple is perhaps the most well-known example.

Public and private blockchains both have pros and cons. Public blockchains often have longer transaction times. But private blockchains are more vulnerable to abuse such as fraud as they’re only partially decentralised.

To help reduce these disadvantages, consortium and hybrid blockchains were created.

3. Consortium

These are permissioned blockchains that are similar to private blockchains – only they’re managed by numerous organisations instead of one. They reduce an organisation breaking the law as each company can hold the others accountable.

Companies can collaborate and work together which is an obvious advantage. Setting one up is quite challenging, though. Having multiple organisations cooperate on something quite technical doesn't come without some difficulty. They also require advanced technology to digitise their data, which means it's very costly.

Two leading examples include Quorum and Hyperledger.

4. Hybrid

As the name suggests, these are a blend between a single organisation and the public being able to perform select transactions like validations. Here, features can be switched to permissionless and permissioned.

However, with greater flexibility, comes less transparency and this deters some from using a hybrid blockchain.

Dapps that need to switch their permission levels often opt for a hybrid model with the IBM Food Trust being a lead example.

Summary

Overall, the number of blockchains is continually growing. There are however, only four types to choose from – whichever an organisation chooses depends on their needs. It's widely accepted this tech needs to solve the trilemma before being able to realistically replace the current financial system.

Do you think blockchain technology has the potential to disrupt our current financial model?

Join us and let us know!

Ready to join the Shares community? Download the Shares app now and make sure to follow us on our socials 👇

As with all investing, your capital is at risk.

Shares is a trading name of Shares App Ltd. Shares App Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority.