Well, when retirement becomes reality, days on the golf course can soon be replaced by stressing over finances, if you haven't planned accordingly.

Although 4 in 5 of us have a workplace pension, one recent study found that only 1 in 5 Brits actually save enough to retire with their desired lifestyle. It seems there is a drastic disconnect on how much we actually need to be saving, but that's exactly what we're here to help with.

TL;DR

Many Brits aren't contributing enough to live their desired lifestyle come retirement

It's been found a couple in the UK need an annual combined income of £47,500 to have a comfortable retirement

A single person would need an annual income of £33,000 for a comfortable retirement

You can budget your expected expenses come retirement, and work backwards to see how much you need to have saved

We've listed 3 quick rules of thumb when it comes to saving for retirement

Show me the money

Okay, so the real reason you're here - how much money you need to save?

As a general rule, financial advisors typically recommend you save 10-12 times your current annual salary by the time you reach retirement.

The average U.K salary in 2022 was £33,000, meaning a pension pot between £333,000 to £396,000 could be a good indication for someone earning an average amount.

But, we're here to help you find your exact amount (or as close to as possible). To do this, create a budget and total up how much the following factors are likely to cost you on a yearly/ monthly basis:

Housing - how much does your mortgage/ rent cost you?

Utility bills - your heating and water bills. Are they likely to increase as you retire?

Food - how much your food shop is. You may find yourself eating out more once you retire, racking up your food expenses!

Transport - fuel, car insurance and public transport costs. Perhaps no longer having a commute will give you more disposable income.

Entertainment - this is likely to increase as you retire, as you'll have more free time.

Your lifestyle - do you want to travel, pursue hobbies or even relocate?

Taxes - you will still be responsible for paying taxes on your income and on any withdrawals from your retirement accounts

Miscellaneous expenses - as clothing, personal care, gifts and subscriptions

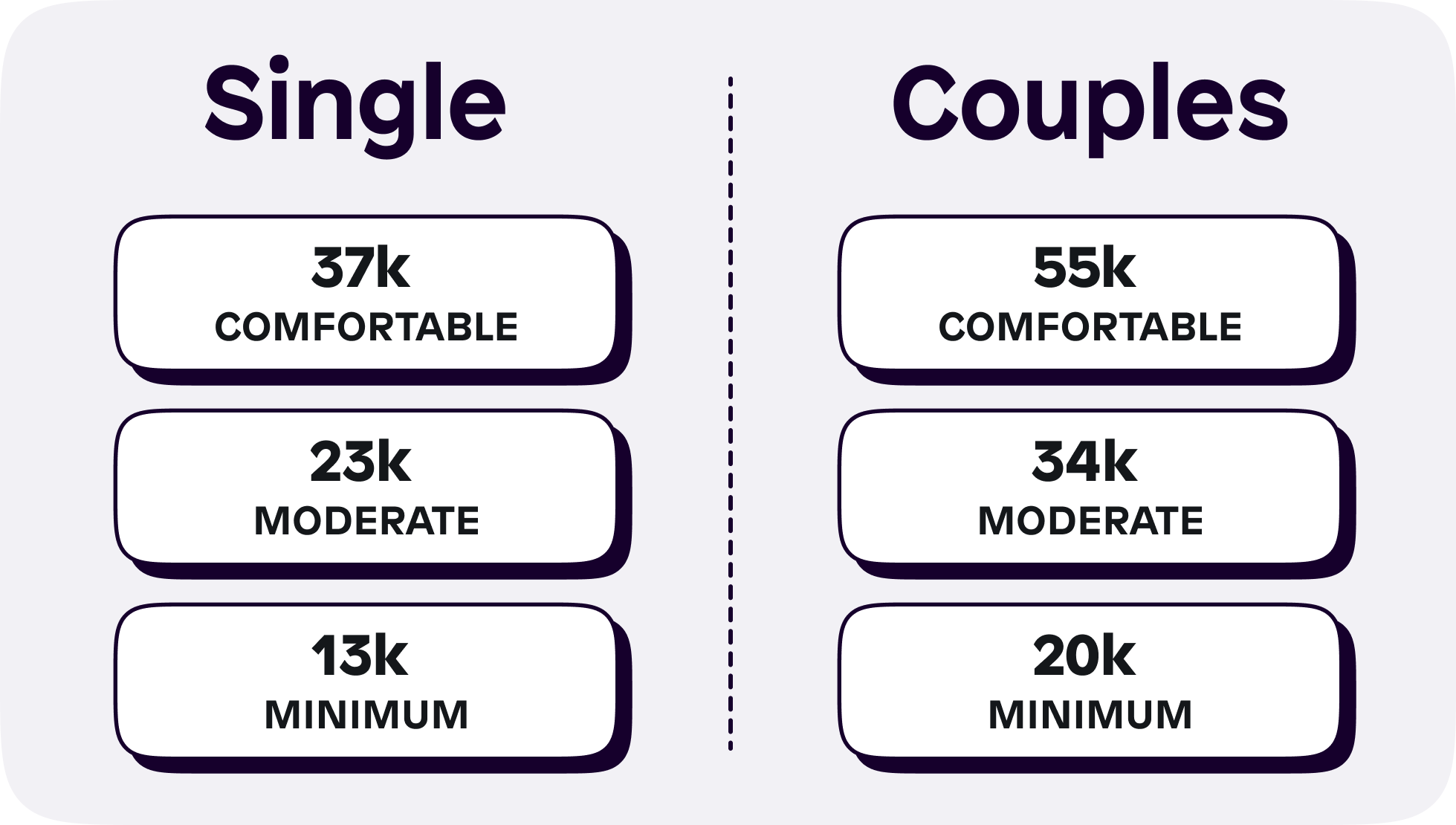

Once you have a strong idea of your overall expenses, it's good to look at the PLSA's (Pensions and Lifetime Savings Association) calculations on how much it thinks people need on average during retirement in its 'retirement living standards’ data. It splits people into 3 categories, depending on how much they wish to spend:

Minimum - for a single person this is £10,200 and for a couple it’s £15,700 which would cover basic costs with some extra money for leisure activities

Moderate - for a single person this is £20,200 and a couple would need £29,100 which would provide a little more financial flexibility and security

Comfortable - for a single person this is £33,000 and a couple would need £47,500 which would allow for financial security and some luxuries

So, match up your forecasted costs and see which category out of minimum, moderate and comfortable you fall into.

How do I know how much to save?

Okay, you now know how much you need each year. But how much does that mean you must have saved in total? Simply use this calculator to figure this out - plug in your details, and it'll do the rest!

It might be that you desire a comfortable lifestyle, but you aren't on track for it. In this case, you'll need to start contributing more to your pension.

General rules of thumb for retirement saving

Whatever your salary is, multiply it by 10. This is how much your pension pot should be

Each year of retirement, you'll need around 2/3s of your latest annual income

Your age divided by 2 is the % amount you should contribute to your pension, from your salary

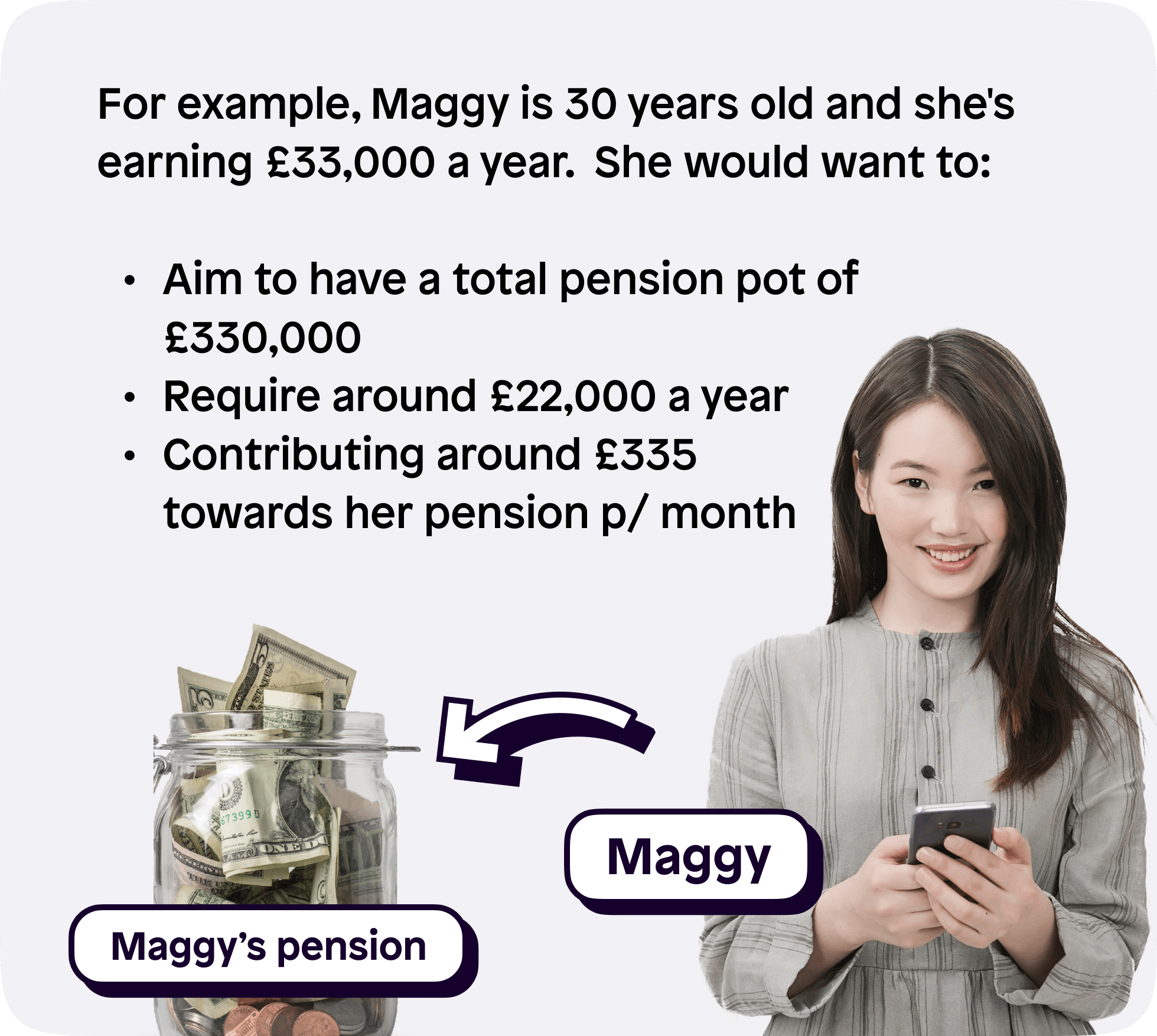

For example, let's say Maggy is 30 years old and she's earning £33,000 a year. She would want to:

Aim to have a total pension pot of £330,000 (33,000 x 10 = 333,000)

Require around £22,000 a year (2/3s of 33,000 is 22,000)

Currently contributing around £335 towards her pension every month (15% of her salary works out at £335 pension contributions per month)

Make sure to check out our other guides on:

Download the Shares app.

Make sure to follow us on our socials 👇

As with all investing, your capital is at risk.

Shares does not provide investment advice. If you are unsure about anything, please seek advice from an authorised financial advisor. Shares is a trading name of Shares App Ltd. Shares App Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority.