Well, think of it like this – stocks, bonds and ETFs are some examples of assets that can be bundled together to form a mutual fund. Then, it's the job of a portfolio manager (or 'asset/ money manager') to group them together and maintain the fund's performance.

As well as being an easy way to diversify your investments, mutual funds allow you to access portfolios managed by professionals, if you don’t want to make investment decisions yourself. Of course, this doesn't come free of charge. You will need to pay a fee for the privilege of receiving the professional's time and knowledge. Fair's fair, I guess? 🤷♂️

Now, you may be thinking "is it a bit risky giving someone else control over my money?" Well, most funds are managed through accredited financial service companies like Fidelity Investments and Vanguard, which employ fund managers who are legally obliged to work in the best interest of you, the investor.

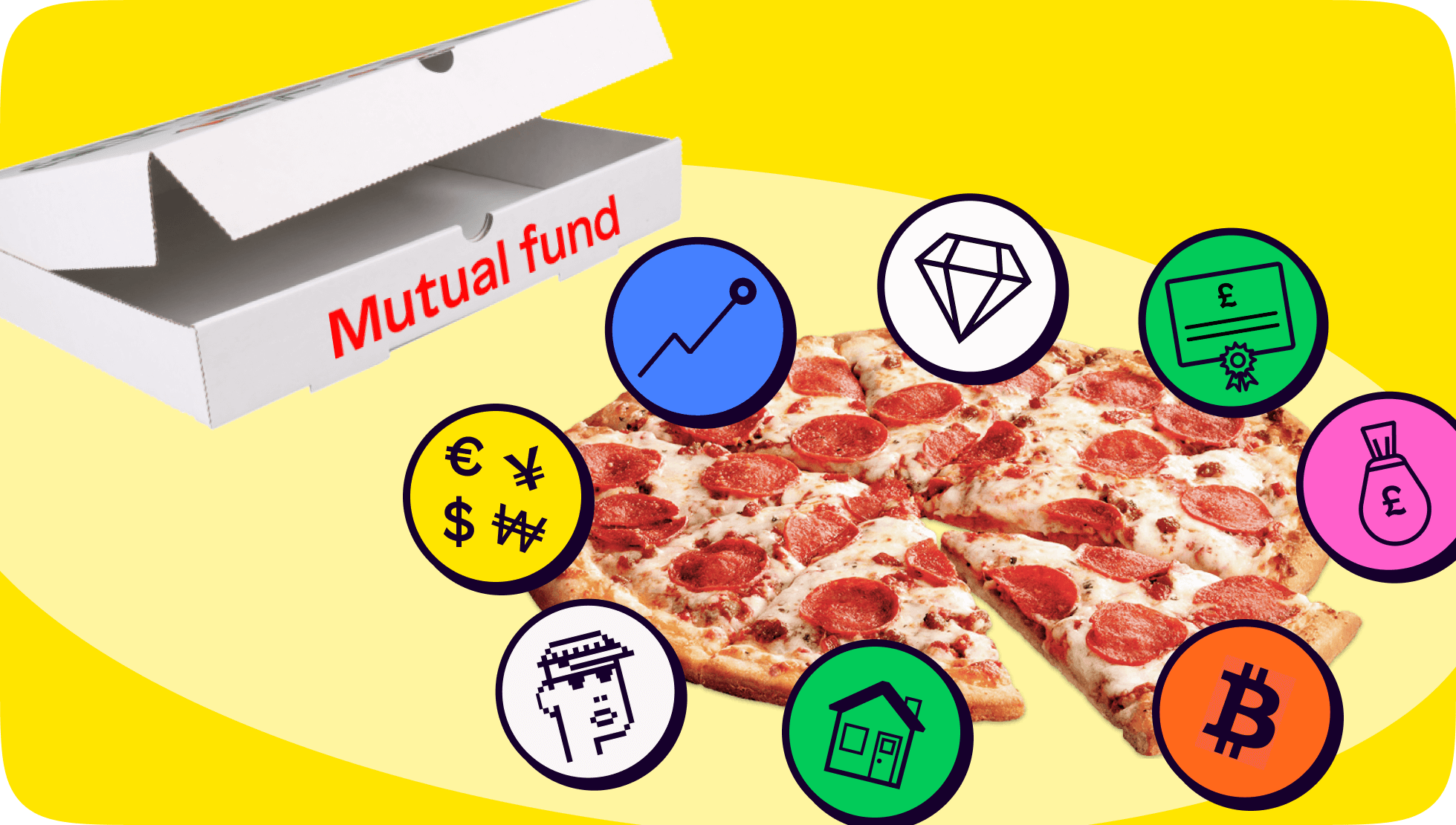

Example of a mutual fund

Still struggling to grasp the idea of a mutual fund? Don't worry. I like to think of it using pizza.

You've just ordered your favourite takeaway pizza – it arrives at your door and you notice it's cut into individual slices.

In this analogy, the pizza box represents the mutual fund and each slice represents a different type of investment.

In essence, we can have 8 different flavours to make up one pizza – pepperoni, BBQ chicken, even pineapple if you're that way inclined. Of course, if you invested numerous shares into a stock, you'd also be ordering one pizza, it's just each slice would be the same. In other words, you'd be less diversified.

See, we ain't just ice creams here at Scoop. We embrace all foods.

Types of mutual funds

So what are the different types of mutual funds? Well, here are 6 of the most well-known.

Stock Funds

From small, mid and large caps, to growth, dividend and blue-chip, there are lots of different stocks you can invest in. As such, you can refine your investment strategy to focus on one of these types and this is known as a stock fund.

Bond Funds

Like stocks, there are many types of bonds. Typically, portfolio managers seek to buy undervalued bonds in order to sell them at a profit, though this doesn't come without risk. A fund specialising in high-yield bonds takes on more risk than a fund orientated around government securities.

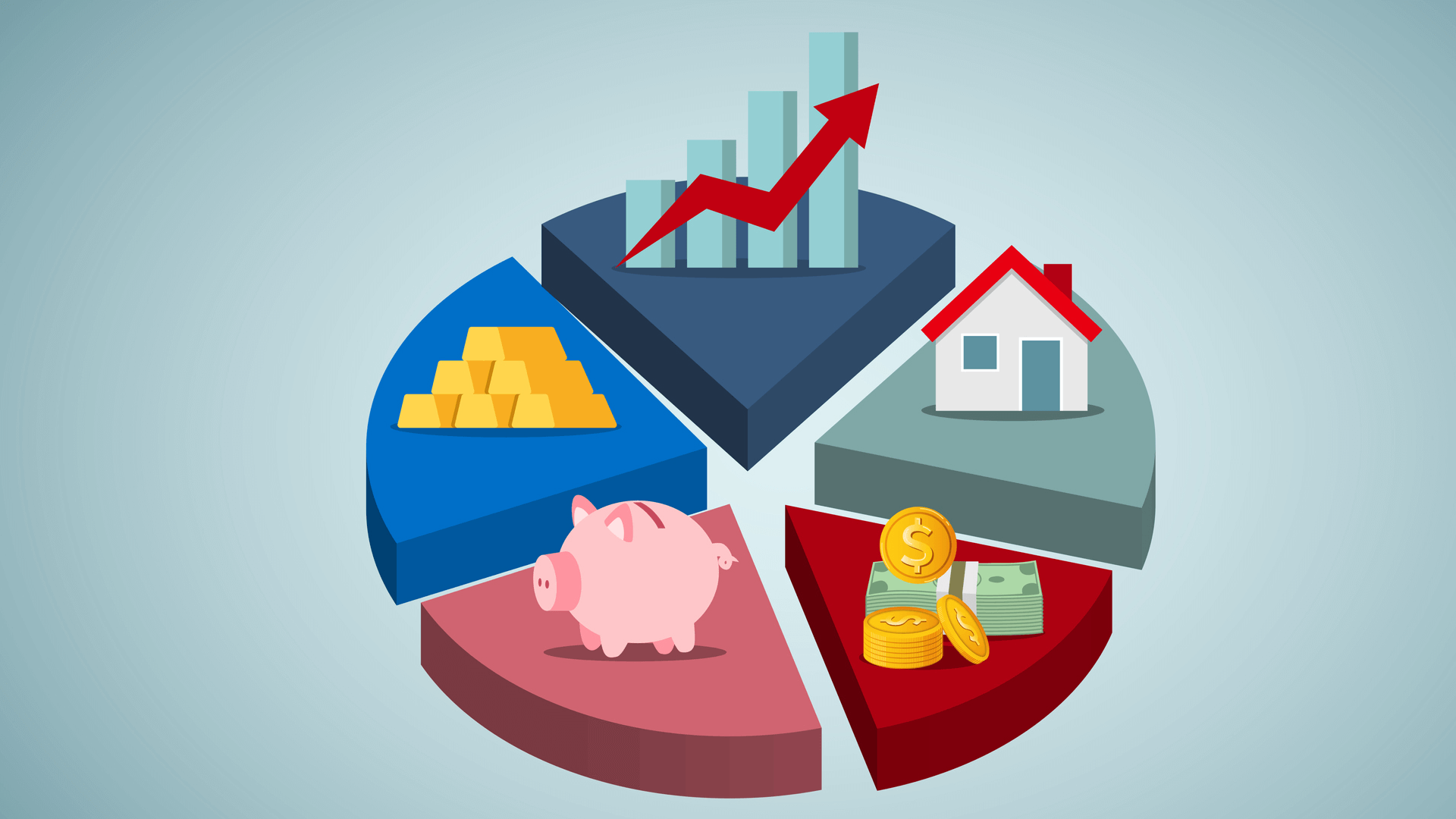

Balanced Funds

As the name suggests, these funds are a mix of assets. Want some dividend stocks, government bonds and a bit of gold in your portfolio? Then a balanced fund may be your preferred choice. The aim of this fund is to reduce being over exposed to one particular asset class.

Money Market/ Income Funds

These are often seen as 'lower risk' investments as they let you hold your savings, rather than grow them, whilst giving you a slightly higher return than cash. They often take on short-term debt from governments, banks and companies with strong balance sheets and high credit ratings. The profit comes from the small return on interest.

Speciality Funds

These funds are refined to specific industries and regions. Examples include technology or healthcare as industries, whilst regions may focus on assets in Europe or Asia, as two examples. Funds can even focus on socially responsible institutions that reject companies which produce alcohol and tobacco.

Tracker Funds

Not all mutual funds are actively managed. Instead, some are set up to track the performance of a specific market (such as the FTSE 100) and mirror that market’s moves. If for example, the FTSE 100 increases 2%, your fund will also increase 2%. One advantage of this is that fees tend to be lower - as the fund is passively managed, it doesn’t require as much work on behalf of your portfolio manager. Lovely stuff.

Mutual funds vs ETFs: what's the difference?

Mutual funds and ETFs (Exchange-Traded Funds) are very similar. But, there is one key difference: the way they're traded.

ETFs can be traded throughout the day on stock exchanges, so their prices fluctuate during the day, like stocks. Mutual funds are only traded once a day after the market has closed.

Mutual funds are typically managed by an individual professional, which also differs from ETFs as you can invest in these directly through an investment platform. Essentially, ETFs still bundle assets together, but you’re the one making the decision when to buy and sell the fund.

What is a managed investment trust?

A managed investment trust pools together funds from multiple investors to invest in a range of assets. Beginners often confuse this with a mutual fund, but the key difference is a mutual fund is where only your money is managed by a professional.

Advantages of mutual funds

Managed by a professional – a mutual fund is managed by a professional, meaning you benefit from their knowledge and don’t have to spend your own time on it.

Diversified – we love the D word around here. Mutual funds can give you exposure to different assets, which means all your eggs won't be in one basket.

Easy to access – once you've got your head around investment assets, mutual funds are relatively straightforward to understand. Thanks to financial service firms, the process of buying them is also quite simple.

Disadvantages of mutual funds

Fees can be high – in exchange for the professional's time and expertise, you’ll need to pay a fee. These fees are taken directly from the value of your fund, meaning it won’t be complicated to do, but you will still be paying them.

There are ‘trade execution rules’ – if you trade a mutual fund, the transaction will occur at the close of the market, irrespective of the time you made the order. For this reason, it's unwise to attempt to 'time the market' or 'buy the dip' and trade mutual funds with the short-term in mind.

You don’t have control over your investments – of course, for some this is a major advantage. But if you're the type who wants to make your own investment decisions, then you may want to reconsider investing in mutual funds. Check out our pieces on stocks and shares and how to research them for a more hands-on approach!

That's all for today, but be sure to check out our guides on:

So, what do you think about mutual funds? Download the Shares app and make sure to let us know in one of our communities!

Follow us on our socials 👇

As with all investing, your capital is at risk.

Shares is a trading name of Shares App Ltd. Shares App Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority.