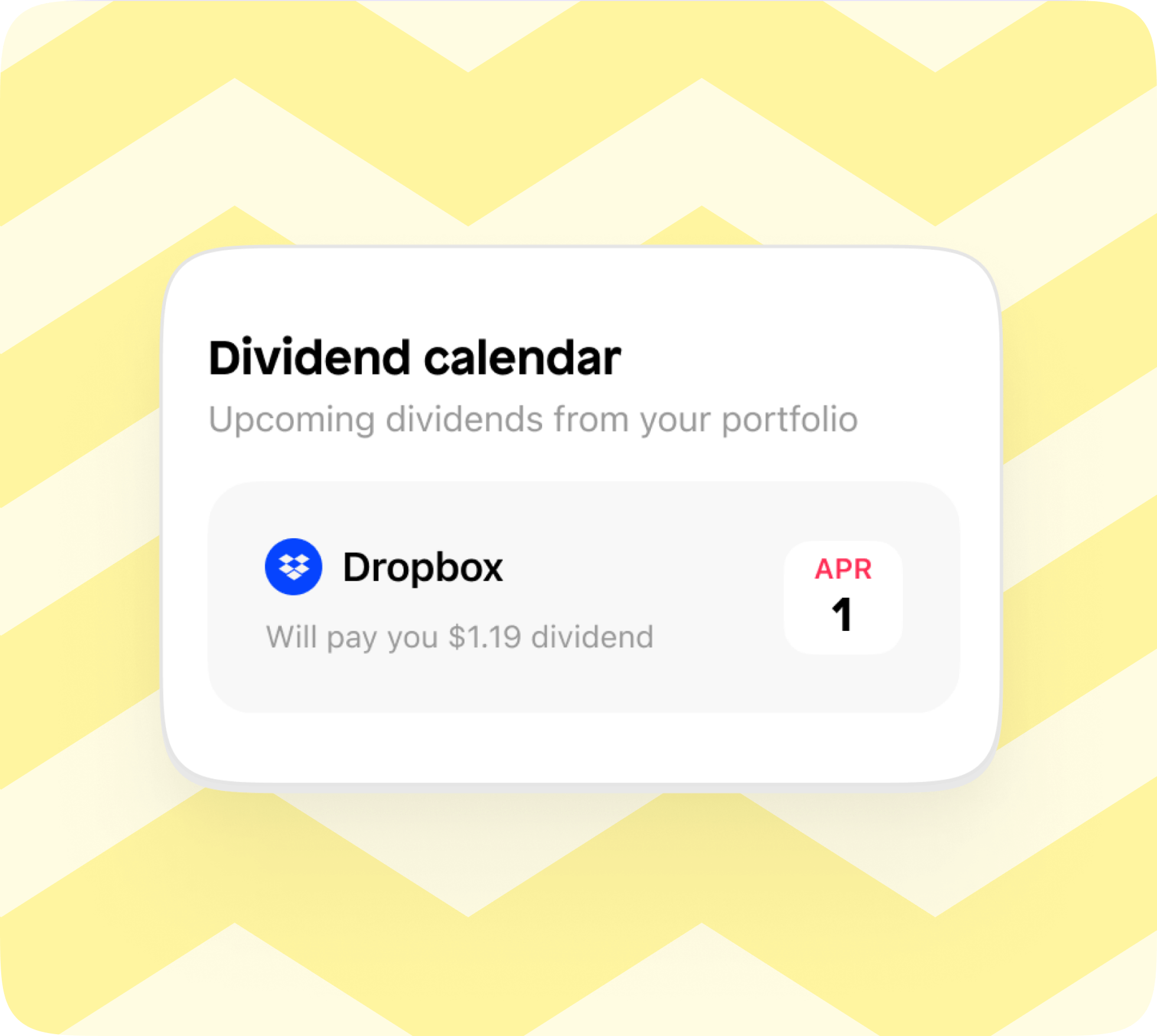

💡 On the Shares app you can earn dividends and track them using our dividend calendar:

What is a dividend?

You might hear them referred to as a 'dividend payment', 'stock dividend' or 'dividend payout' but they all mean the same thing.

Essentially, they are payments made to you for simply owning a stock. Not all companies pay them, but the ones that do publish their 'dividend yield' which is a fancy term for saying how much they'll pay you.

That's why some people wondering where to invest money to get monthly income often opt for dividend stocks.

How often are dividends paid?

Dividends are typically paid out four times a year. Some companies may pay out just once or twice, but the vast majority pay at the end of every quarter.

Here's an example of a dividend payment:

Meet Lisa 👋.

Lisa invested £500 into Coca-cola stock using the Shares app. Coca-cola has a dividend yield around 2.87% at the time of writing. So, 2.87% of 500 = 14.35. Coca-cola pays their dividends 4 times a year. Therefore, 14.35 / 4 = £3.58. That's how we know Lisa receives £3.58 once every 3 months.

In other words, Lisa receives 2.87% of however much stock she has in Coca-cola. If Lisa owned an additional £100 in Johnson & Johnson stock, then she'd receive £4.08 a year. Again, this is because J&J has a dividend yield of 4.08%.

£3.58 once every 3 months might not sound like a lot, but as with all investing, keep context in mind. People often choose steady dividend stocks as an alternative to the interest of a bank account.

Not to mention, they can be automatically reinvested into your stocks which help them grow. This allows for compound interest, which especially when you’re young, is an extremely powerful form of interest.

For many, it’s also an added bonus. If someone buys a stock because they think the share price will grow over time, then these extra payments are essentially free money along the way!

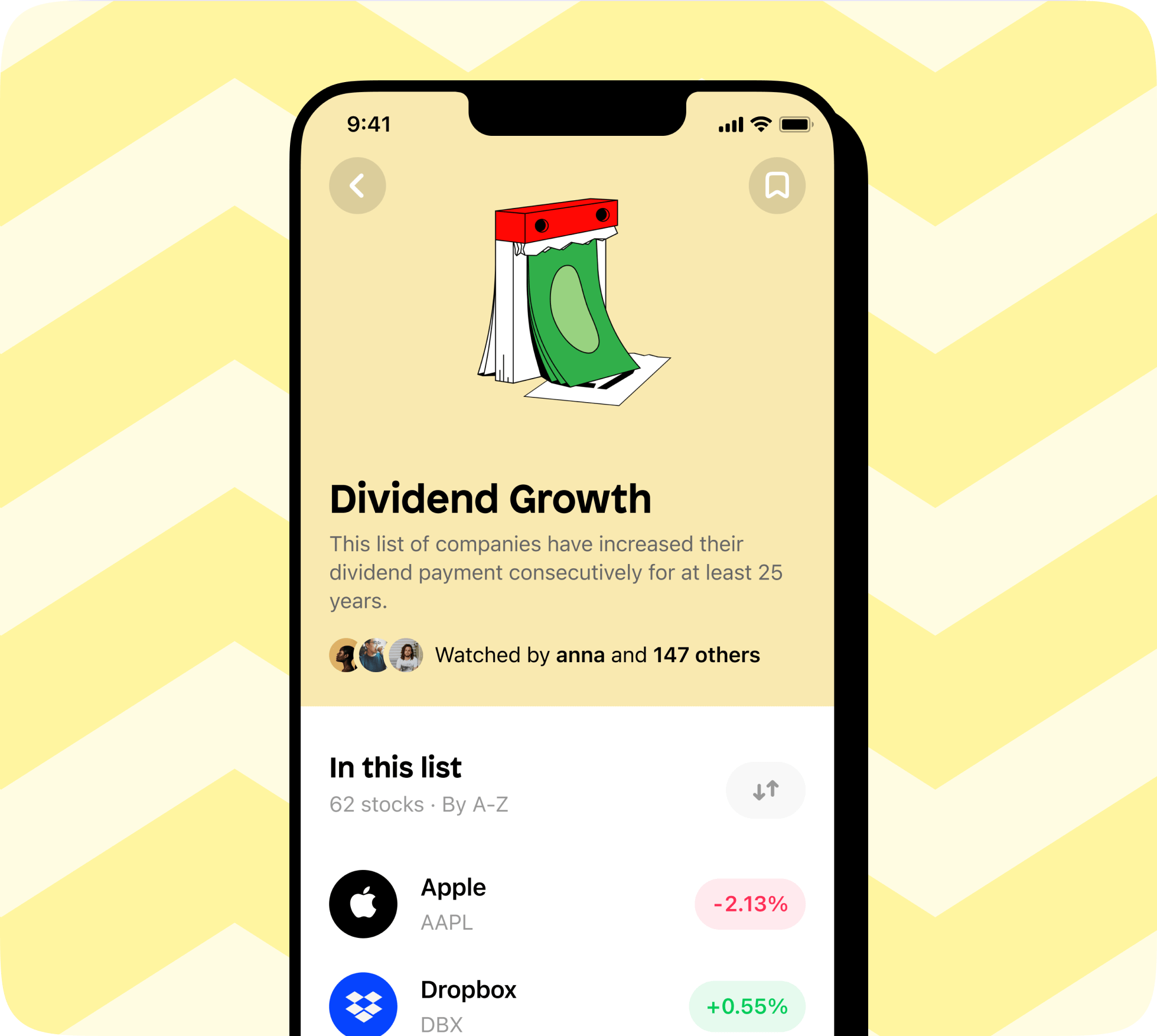

Shares' dividend collection

On the Shares app, we've categorised a list of dividend paying stocks under our dividend collection. These companies have been paying increasing their dividend payments consecutively for 25 years.

Dividend kings 👑

A stock that is a 'dividend king' is a company that has paid dividends consecutively for 50 years AND increased the price at least once a year. Oh, and the company also needs a market cap around £2.5 billion. Yep, you don't get given the name king for nothing 😅.

Naturally, these companies have built up excellent trust with their shareholders and much of their model for raising investment comes from this strategy.

Dividend aristocrats 🎩

'Dividend aristocrats' are the same as kings, except they have been paying and increasing dividends for at least 25 years but under 50. Similar to kings, aristocrats also require a market cap around £2.5 billion.

Warren Buffett's dividend success

There are plenty of non-king or aristocrat stocks that come with lots of opportunity though. Sometimes getting in early can result in big rewards, just as Warren Buffett found out.

At the start of this article I mentioned dividends are one of my favourite aspects of investing, and here's why.

The famous story lies with Berkshire Hathaway (Buffett’s company), who spent around £1.075 billion on Coca-cola shares in 1988. In 2021, the company earned £556 million in dividends alone. £556 million for doing nothing except own the stock. If that isn't passive income, I don't know what is!

Also keep in mind:

This wasn't a one off payment; they'd have also received dividends continually from 1988 onwards

This doesn't even take the growth of the stock price itself into consideration

You are paid out on the amount of shares you own, not the amount you paid. This is key as it allows an investor to grow with the company

Do you pay tax on dividends?

You don't pay tax on your first £2,000 worth of dividend earnings. This is known as your 'dividend allowance'. This resets after each tax year, but the government can change this figure at any time, so make sure to check its present day rate via the governments dividend tax page.

Dividends received from an investment ISA are also free from income tax.

Outside tax-free/deductible accounts the dividend tax rates are:

8.75% for basic rate taxpayers

33.75% for higher rate taxpayers

39.35% for additional rate taxpayers

Jeremy Hunt, Chancellor of the Exchequer, said in the personal allowance is set to remain at this level until April 2028 in his November Autumn Statement.

Overall, dividends do not count as your regular income as they are taxed at a different rate.

And there you have it, the wonderful world of dividends. If you want to talk more about dividends then download the Shares app and message me what your favourite dividend stock is!

Join us

Make sure to follow us on our socials 👇

As with all investing, your capital is at risk.

Shares is a trading name of Shares App Ltd. Shares App Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority.