Now, you might be thinking that a football tournament has little to do with the world of stocks and finance. But research has shown that when a nation loses at the World Cup, it has a profound impact on that country’s stock market.

A study called “Sports Sentiment and Stock Returns”, put together by an all-star team of finance professors, looked at stock market behaviour after more than 1,100 football matches going back to 1973.

They found that, on average, if a country’s football team lost at the World Cup, its stock market produced significantly below-average returns the following day. For example, a loss in the knockout stage led to a next-day return of -49 basis points (aka -0.49%).

Curiously, though, the boffs didn’t find a correspondingly positive effect on the stock markets of countries that won. 🤷 Strange, right?

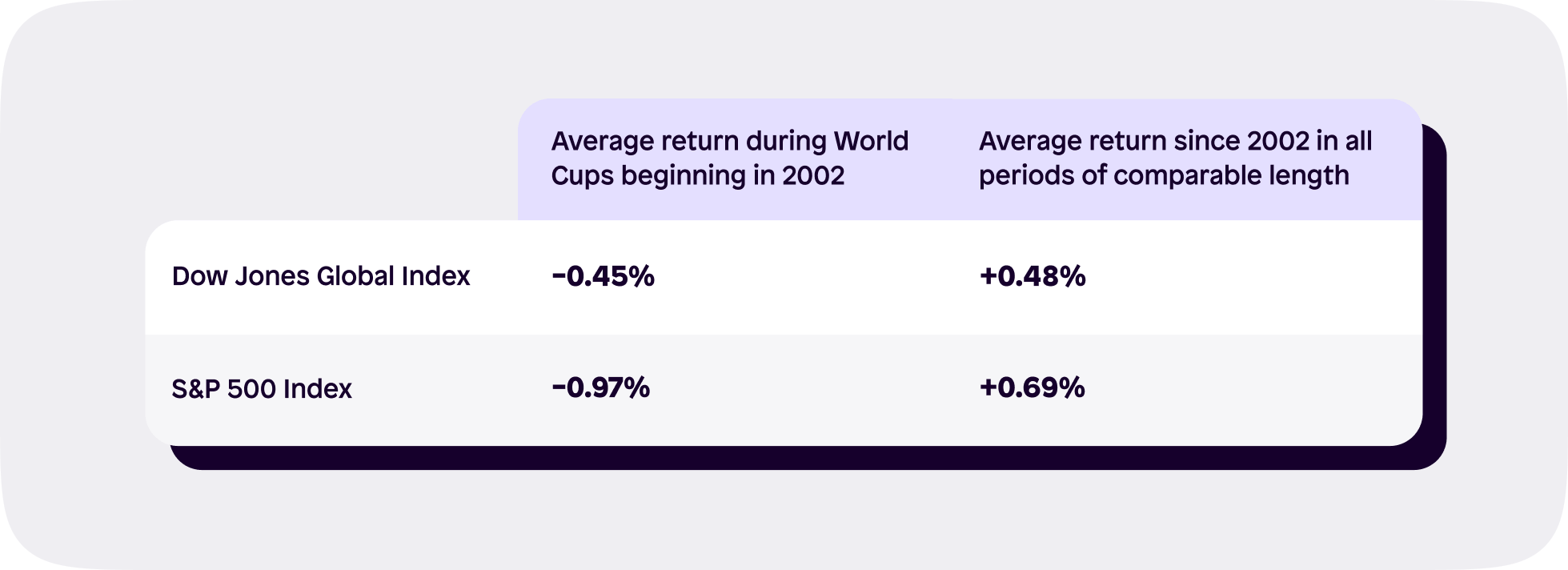

Well, it turns out that global stock markets are sluggish performers during World Cups anyway. A follow-up study called “Exploitable Predictable Irrationality: The FIFA World Cup Effect on the U.S. Stock Market,” found that stock markets offer negative average returns during World Cups, but see a general uptick in performance outside the competition.

Since World Cups only roll around every four years, the sample size is obviously pretty small, but the evidence of a ‘World Cup Effect’ still exists.

The big question is why?

Well, the study suggests that as the tournament progresses, the number of losing countries increases, until eventually there’s only one winner and dozens of losing nations. This mass dejection naturally leads to negative stock performances over a six-week period.

Now, before you go thinking it’d be a wise move to sell up now and resume your investment journey after the tournament, it’s important to note that many other factors will also play a big role in determining the stock market’s direction over the next couple of months. And just because the market behaved one way in the past doesn’t guarantee it will behave the same way in future.

The broader point here is that our moods play a powerful role in our investment decisions. As much as we’d like to think they’re always based on clear, level-headed analysis, that’s just simply not the case.

So, while I’ll be devvoed when England inevitably crash out on penalties in the quarter finals, I’ll try not to let the heartache impact my investment decisions.

Good luck, boys! Bring it home. 🏆

Don't forget to download the Shares app and remember to follow us on our socials 👇

As with all investing, your capital is at risk.

Shares is a trading name of Shares App Ltd. Shares App Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority.