The same logic applies with motivation and investing. If someone told you to invest because 'it's the sensible thing to do' would you do it? Probably not.

But what if I showed you three calculators that help show you what your finances could look like with investing? (Numbers forecasted with some of these calculators are based on historical performance and it shouldn't be assumed you will see these exact returns).

First up on our list...

1. Take home pay calculator

This wonder tool automatically deducts tax, national insurance, pension contributions and student loans from your gross salary. It leaves you with your ‘take home’ salary which is a more accurate (and not as appealing 😞) figure of how much ends up in your bank account at the end of the working month!

All you have to fill out is the following:

Tax code - this will be on your payslip. Don’t worry if you’re not in employment yet, you can leave this blank.

Salary – simply enter your salary.

Student loan – if you didn't apply for a student loan, then skip this section.

If you started your undergraduate course before 1st September 2012 or you lived in Scotland or Northern Ireland tick “Repayment Plan 1”. If you started your course on or after 1st September 2012 and you lived in England or Wales Tick “Repayment Plan 2”. Tick “Postgraduate” if you have applied for a postgraduate student loan.

Pension – contact your employer or view your payslip to see how much % you're contributing to your pension.

Childcare – if you are eligible for childcare you can enter the monthly value of vouchers you receive.

Other deductions under additional options (optional) – use these for your additional monthly costs. Don't sleep on your Spotify, Xbox and Netflix subscriptions – they all add up and we know you’re using them! 🕵️♂️

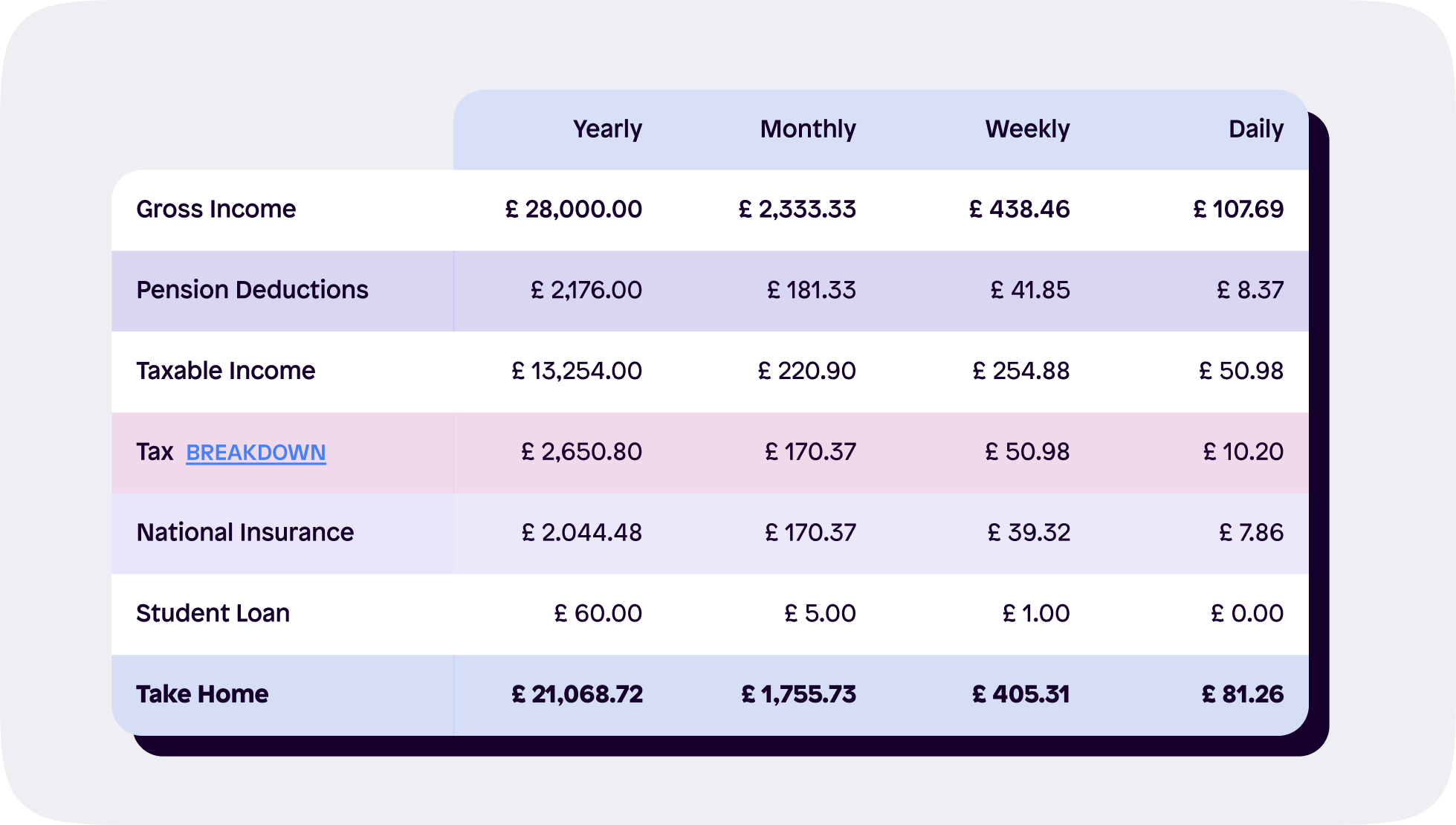

In this example, Gemma earns £28,000 a year, has a student loan with a repayment plan 2 and contributes 10% of her salary towards her pension.

Although Gemma earns £28,000, her take home pay is actually around £21,068.

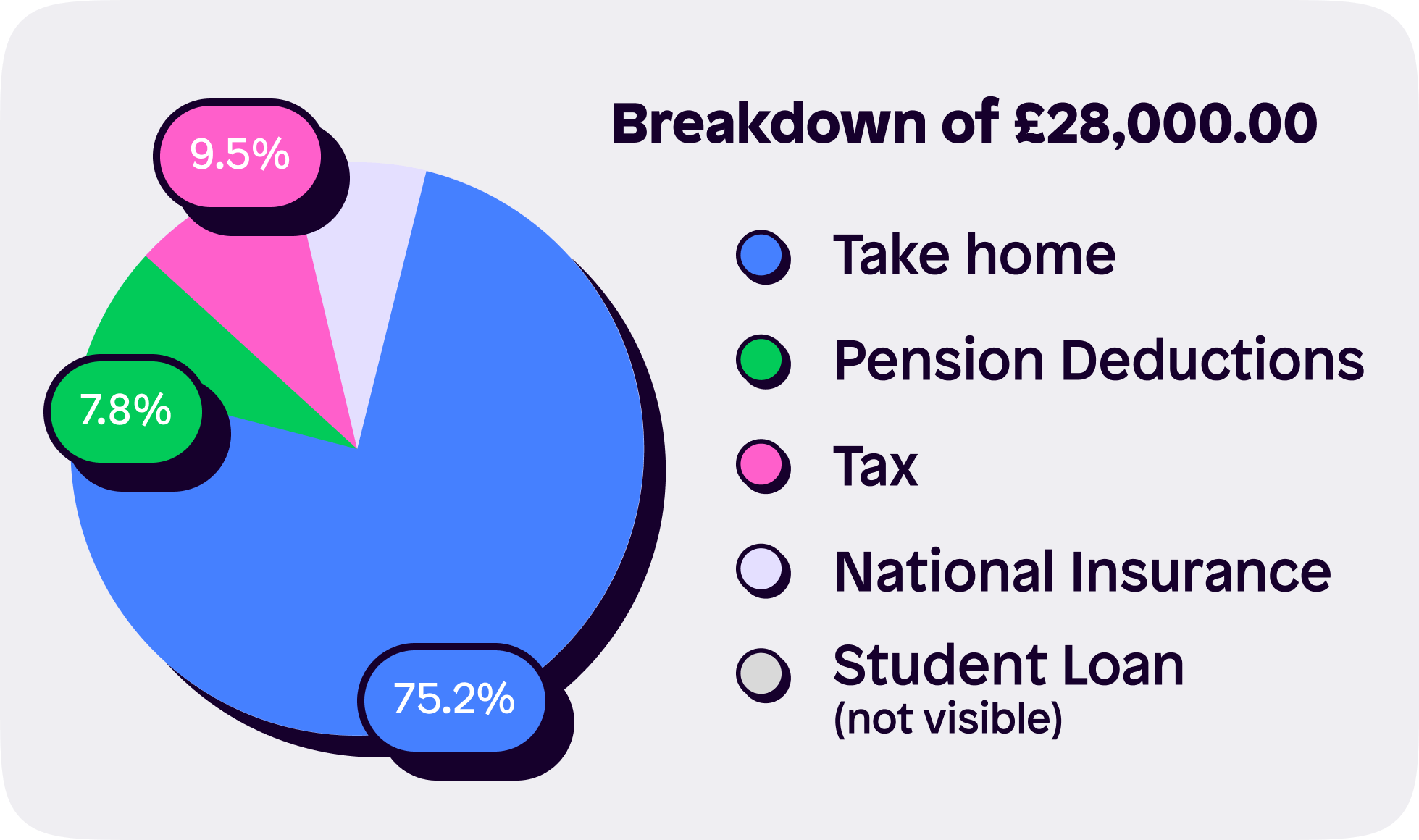

Here’s a more visual breakdown of Gemma’s take home pay.

Keep in mind, the pie chart doesn’t show student loan as it’s such a small repayment (£1 a week!).

Now Gemma has a much better understanding of how much she’s actually taking home. She can do this by subtracting her costs (food, rent, socialising, savings etc) each month from £1,755. If she wanted to begin investing, she could do so with whatever amount is left.

2. Compound Interest Calculator

Before visiting this calculator, make sure you know what compound interest is. A compound interest calculator forecasts the interest earned on interest over a set period of time. You set your rate of return, your contributions and how long you wish to invest for.

Once you're familiar with compound interest, start filling out the following:

Initial balance - the amount you currently have ready to invest in one go. For example, you may wish to invest £2,000 and then £100 a month afterwards. Your initial balance would still be £2,000.

Interest rate - this is the % of profit your investment is making you, simply for being invested. For example, £100 invested with a 10% interest rate will generate you £10. With compound interest, profit is reinvested to create quicker growth. The reinvestments can be paid each month or year, depending on your investment.

Years/ months - how long you wish to keep your investments invested! For example, a 30-year-old man wants to stop investing at 55 years old - that’ll be 25 years and 0 months for him.

Compound interval - this is how often you wish to 'top up' your investment. If your contributions are monthly, then leave it on monthly. If they are yearly, change to yearly etc.

Deposit amount - the amount you wish to contribute every week/month/year.

Hit calculate!

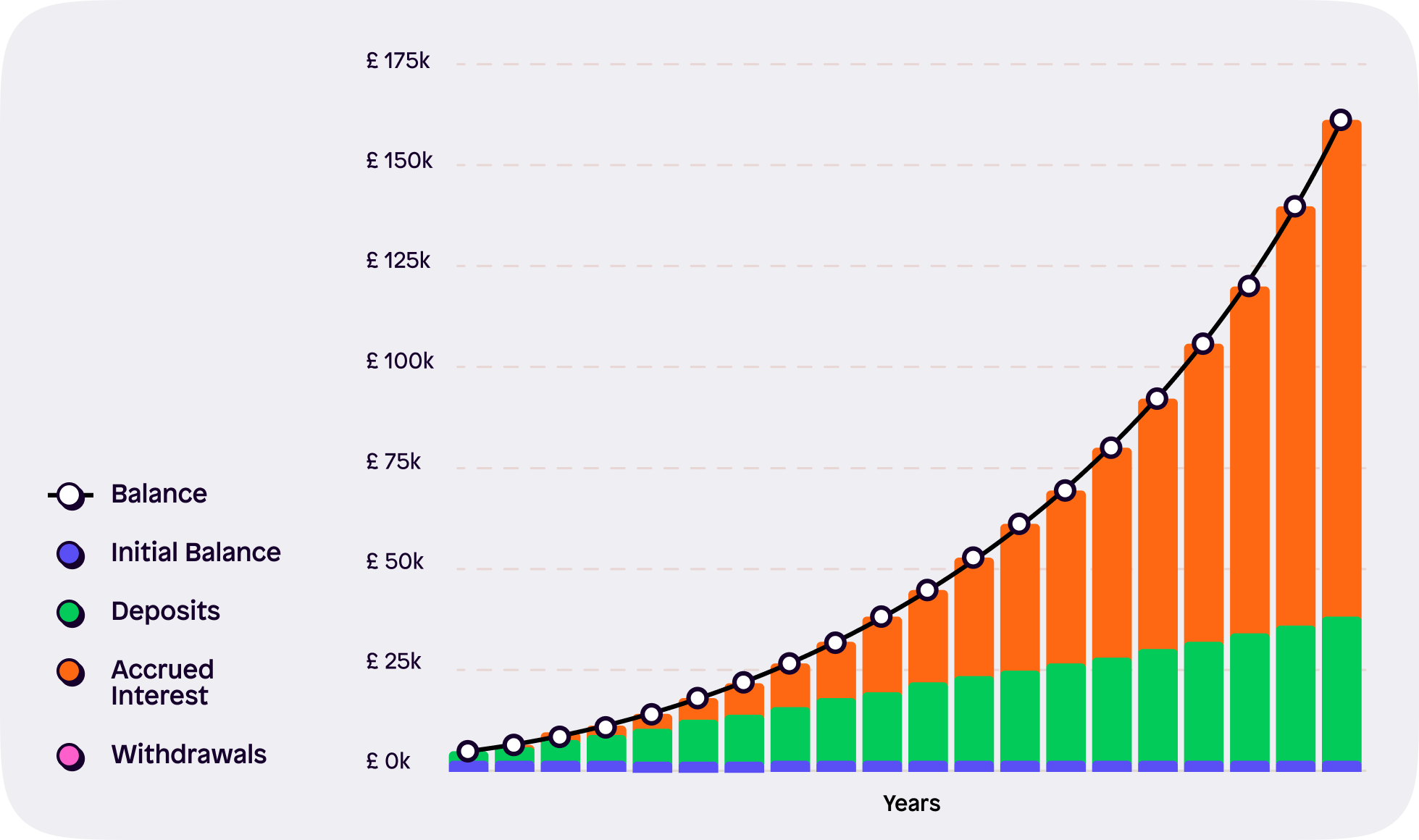

Below is an example of the above. An initial balance of £2,000 at a 10% interest rate, with £100 contributed every month for 25 years generates the following results.

If graphs aren’t your thing, allow me to explain.

Overall, £32,000 has been invested. £2,000 to begin with, then £100 for 30 years. Thanks to compound interest though, the amount of this portfolio isn’t £32,000. An additional £124,797 has been earned taking the total value up to £156,797.

Yikes.

3. Pension calculator

This pension calculator lets you forecast your likely retirement income. It’s connected to how much you intend to spend during retirement. Low income isn’t a problem if you intend to live frugally, but if you’re after the yachts and Lamborghinis then you’ll need a higher retirement income.

Step one is deciding how much you want to live off during retirement.

That's quite a difficult question to answer when you're not close to retiring. It might be best to fill this out two or three times with different amounts until you find a result that's right for you.

About you - fill in your age, gender and the age you'd like to retire.

Your income - fill in your current salary and your target retirement income.

Pension contributions - log in to your pension provider and view your 'pension pot'. Fill this in. Check your payslip and see how much you and your employer are contributing each month and fill this in too.

Lump sum & other income - decide how much you'd wish to take out as a lump sum (in one go) and include any other income you might have (examples include investments such as stocks and property).

View your results - you'll be shown how much you need more/less you need to invest into your pension to meet your goals.

There you have it, three calculators to not only help you manage your finances, but get excited about them.

Download the Shares app!

Make sure to follow us on our socials 👇

As with all investing, your capital is at risk.

Shares is a trading name of Shares App Ltd. Shares App Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority.