💡 If you want these updates delivered to your inbox every Friday, sign up here

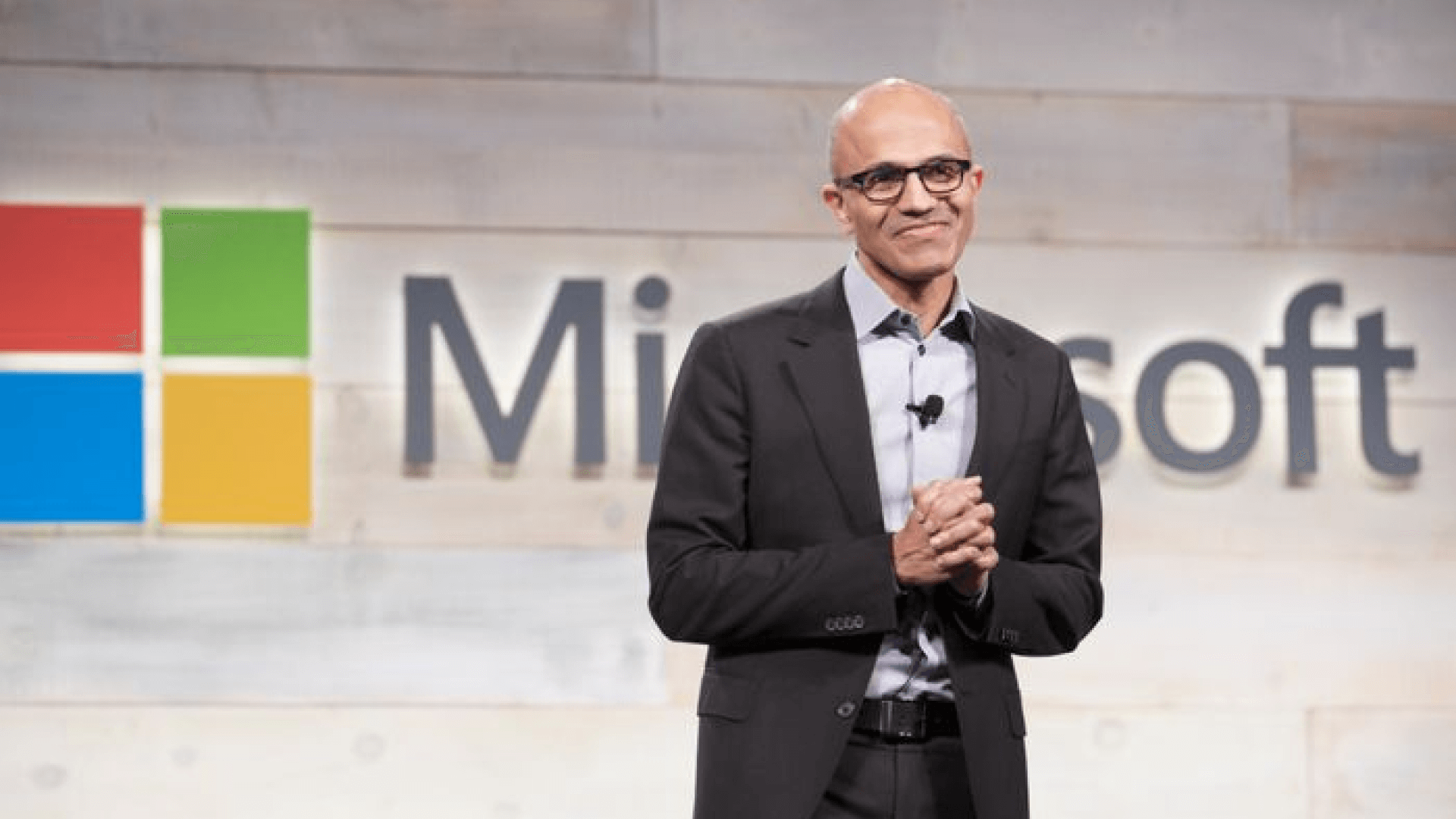

Microsoft jumps 9% thanks to its cloud technology ☁️

Every cloud has a silver lining: Since the pandemic, cloud technology has taken a hit as businesses have scaled back their cloud operations. Analysts had expected this trend to continue in Microsoft's earnings call on Tuesday, but the tech giant had other ideas in mind.

AI to the rescue: Revenue for Microsoft’s cloud department is up 16%. CEO, Satya Nadella, told investors that the company had more than 2,500 customers in its new Azure-OpenAI service. There’s no doubt customers are becoming increasingly excited about Microsoft’s AI developments.

Net income is up: Microsoft was forecast to hit net income levels of $16.6bn, when it actually hit $18.3bn. Outperforming expectations by $1.7bn is significant, and whilst much of it is down to AI, savvy investors will know Microsoft’s services and content divisions (think Xbox, LinkedIn, Skype) increased 3%, keeping its business model nice and diversified.

Spotify wraps up impressive earnings as stock gains 6% 🎶

Music to investors’ ears: Investors were all ears for Spotify’s earnings call on Tuesday, as subscribers and gross margins look to be in a healthy state.

Surge in subscribers: Last month, Spotify revealed it crossed half a billion active users. Yep. Half. A. Billion. Wall Street applauded and predicted Spotify to announce around 207 million paid subscribers for Q1, but instead, the music streaming company actually announced 210 million.

Meaty margins: Spotify beat gross margin expectations by 0.3% thanks to laying off 6% of its workforce last month. The company raised investor excitement, by stating gross margins could rise to over 30% as it looks to scale its podcast and ad businesses.

Google’s parent company, Alphabet, climbs 4% 🔠

Exceeding expectations: Like Microsoft, Alphabet was expected to report a lacklustre set of earnings. But, Google’s advertising business also topped forecasts and returned to growth, helping Alphabet exceed revenue expectations by almost $1 billion.

Stock buyback: Alphabet announced a huge $70bn stock buyback, and this got investors excited, as clearly Alphabet is confident about its future earnings. It also indicates the company deems its own shares as undervalued, which investors love to see.

Google’s head is in the cloud: Advertising is a prolific part of Google’s business model, but as Microsoft is showing, there is potential for AI to boost cloud technology. Google is quickly developing Bard, its rival to ChatGPT, as well as many other new AI features under the Google Cloud Security AI Workbench umbrella.

What have we learned this week? 🤓

Tech is picking up, and it has AI to thank: Microsoft and Alphabet have been in a tough place with cloud technology in recent years. But integrating AI is rallying up paying customers, which is good for their stock.

Spotify has a successful ‘freemium’ model: A ‘freemium’ model is when a company offers a service for free, but also has a paid tier. Almost half of Spotify’s customers subscribe to its paid plan, which as freemium models go, is impressive.

Investors love stock buybacks: Nothing gives investors confidence like seeing a company buy its own shares back off the market. It’s the ultimate nod of confidence a company can give to its own stock.

Thanks for tucking in! Want to receive these updates every Friday? Sign up here or share via WhatsApp with your friends.

*Figures correct as of April 26th 2023.

Past performance does not guarantee future results. Capital at risk when investing.

This content is for educational purposes only. Shares does not provide investment advice. If you are unsure about anything, please seek advice from an authorised financial advisor.