But just like Harry did in the Forbidden Forest, we're going to tackle this dark wizard of a term head on. We'll be looking at what causes a recession, what to do in a recession and whether the UK is currently in one.

So then witches and wizards, ink cartridge and quill sets at the ready.

Definition of a Recession

👩🏫 The official definition – a recession is a significant and prolonged downturn in economic activity.

This is generally identified by a decline in economic growth (measured by Gross Domestic Product or GDP) for two quarters in a row.

A healthy economy expands over time, so if output falls for two quarters, it’s a sign of some serious problems. During recessions, unemployment rises, companies make fewer sales, manufacturing slows and living standards fall.

😍 A relatable definition – when the economy is doing badly.

This is usually due to consumers spending less money. This is often caused by consumer goods, fuel and services increasing in price, otherwise known as inflation. In a recession, our income doesn’t stretch quite as far because everything is becoming more expensive.

When our income doesn’t stretch as far, we spend less in order to save. Unfortunately, this means other people, such as business owners, receive less income too. These businesses might make cutbacks, causing people to lose their jobs. If people lose their jobs they’re likely to spend less, creating a downward spiral.

You may have noticed your Netflix subscription has increased, which is a direct cause of inflation. Netflix is a luxury, which also means it's one of the first things people get rid of when times are tough. Unfortunately, Netflix raising their prices by a couple of quid isn't the worst part of a recession.

What happens in a recession?

Unemployment increases

Corporate profits drop

House prices often crash (good for some I suppose, eh 😉)

Inflation increases as companies need to 'pass on the cost' to consumers to ensure they're still profitable (cheers Netflix, son's crying)

Less investment takes place, meaning fewer revolutionary businesses are born

Living standards may fall

Governments take on more debt to help people live, which we all have to pay back later

What causes a recession?

Typically, there is one main cause (a catalyst) that causes a recession. This could be:

A sudden economic shock - like a pandemic or war

Too much debt - when people and businesses borrow too much money, they may end up missing payments or going bankrupt

Asset bubbles - housing bubbles or stock market bubbles can burst, causing panic selling, crashing the market

Too much inflation - prices go up too quickly (as explained above)

Too much deflation - prices go down too quickly, which can cause wages to go down, so people spend less

Technological change - new inventions usually trigger a period of adjustment, e.g. the Industrial Revolution made many people’s professions obsolete

In 2022, the war in Ukraine has prevented local farmers from trading wheat. This is a problem, as According to Ukraine's Ministry for Agriculture, they supply 40% of the world’s wheat. The world has had to look to other wheat sellers, meaning demand has increased. The ‘knock on’ effect is that buyers have to pass this increase in cost to consumers, hence why your pack of pasta may be a little more pricey than usual.

This increase in costs then causes more ‘knock on’ effects to negatively impact the economy. This downward trend continues and frequently results in a recession.

Example of a recession in Harry Potter terms

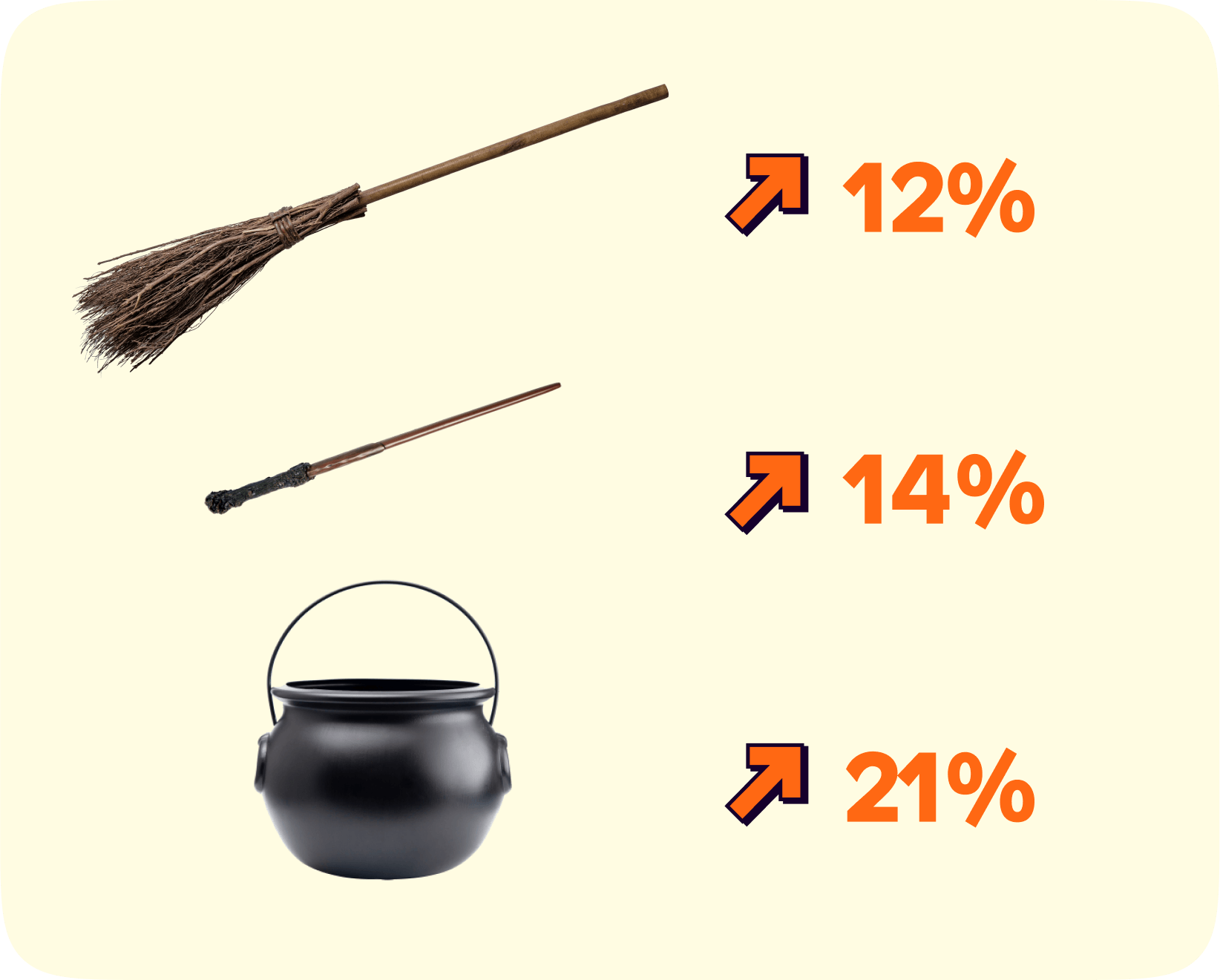

Think of the shop called Ollivanders that sells magic wands to local customers. The shop owner, Ollivander, has local customers that keep him in business. He relies on their business to pay his mortgage and bills each month, which they're happy to do because his wands are the highest quality around.

But, thanks to the rising costs of broomsticks, gowns and polyjuice potion, local customers start re-budgeting and decide they'll buy their wands from a cheaper shop.

This drives Ollivander out of business. Ollivander has to stop hiring two part-time workers he employs during the weekends, leaving them without a job. These workers have less money now they're unemployed and decide they need to re-budget too. They decide to cancel their weekly Quidditch classes, meaning less income for their Quidditch teacher. The vicious cycle continues.

Although this is a basic example, it happens on a global scale. That's why a thriving economy is one that is always spending money.

Is the UK in a recession?

Expecto Patronum? More like expensive petroleum.

Although we haven't been labelled in a recession officially, the BBC state sharp prices in energy and people’s incomes continuing to fall after adjusting for rising prices indicate a recession is looming. The Bank of England have predicted that we'll officially be in one by the end of the year.

Overall, investors should know the stock market hasn't liked it when we've entered a recession in the past. Whilst the stock market factors in inflation, one thing it can't predict is how people will react to the news if (or when) the official announcement comes that the UK is in a recession.

News like this travels fast, investors sell their assets and this causes stock prices to drop. The cycle continues as people panic and 'cash in' their shares.

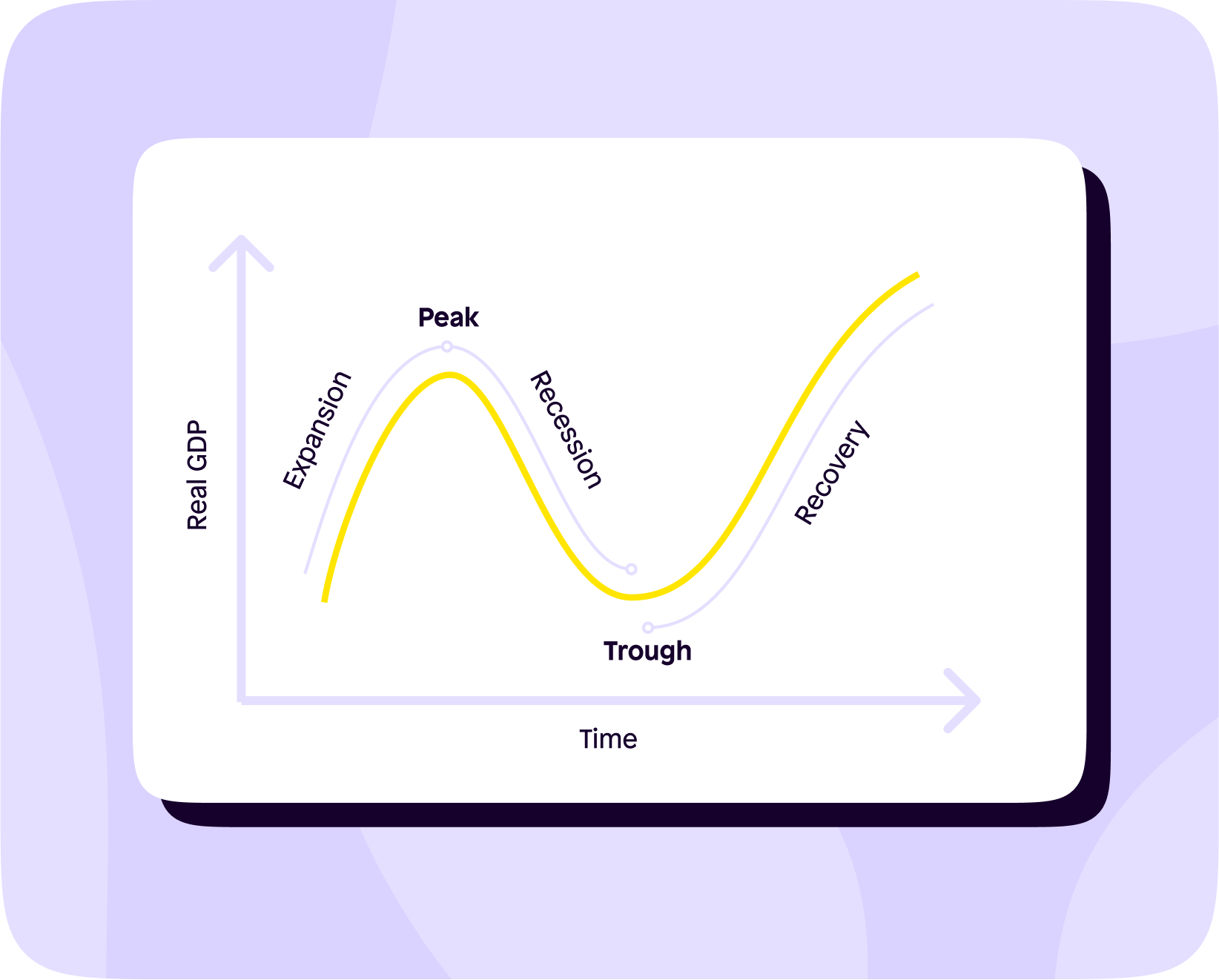

That’s why a dip in the market post peak is labelled as a recession. Of course, once we’ve hit the trough and the market picks up again, this is called the recovery.

What to do in a recession?

What you can do

For starters, don't do a Ron Weasley and drive to school when you can get the train for free. C'mon Ron, that's costly and bad for the environment.

You might be better off doing a Fred and George, and start up your own side hustle. Just, keep away from making sweets that cause children to throw up everywhere. Not financial advice, just advice.

You can also focus on your own money management. Explore side hustles to bring more funds in, budget better using online calculators and check out our tips on how to remain frugal.

What the government can do

There are a few things the government can do to help combat a recession.

Fiscal policy

They may introduce a ‘fiscal policy’ to kickstart the economy. This could involve lowering tax rates to give people a higher take-home pay. This policy tends to focus on helping the most vulnerable groups.

The government may decide to increase their own spending, and introduce schemes to support the economy. During the COVID-19 pandemic, Rishi Sunak introduced the ‘eat out to help out’ scheme to help restaurants, and abolished stamp duty on certain homes to boost the housing market.

Quantitative easing

‘Quantitative easing’ is a nice bit of jargon which aims to increase the prices of assets like shares and property.

For example, the Bank of England may buy millions of pounds worth of government bonds using cash. The government will invest this cash into other assets such as shares, that give a greater return.

In turn, that often increases the value of shares, making households and businesses who own those shares wealthier.

As we know, a recession occurs due to a catalyst causing a chain of events. The same process (but in reverse) also has to happen to help recover the economy.

Recovering from a recession

Aside from that, a good plan is to always wait for the recovery. Nothing beats time. Many investors use a recession to increase their positions as investment assets such as stocks are low. A recovery begins once consumers regain confidence. The unemployed become employed and once again have capital to spend. As we know, a spending economy is a strong economy.

Well, that was all a bit dramatic. Think I'm ready to get back on the Hogwarts Express and get a butterbeer down me. See you in Diagon Alley.

Download the Shares app today.

Make sure to follow us on our socials 👇

As with all investing, your capital is at risk.

Shares is a trading name of Shares App Ltd. Shares App Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority.