💡 If you want these updates delivered to your inbox every Friday, sign up here

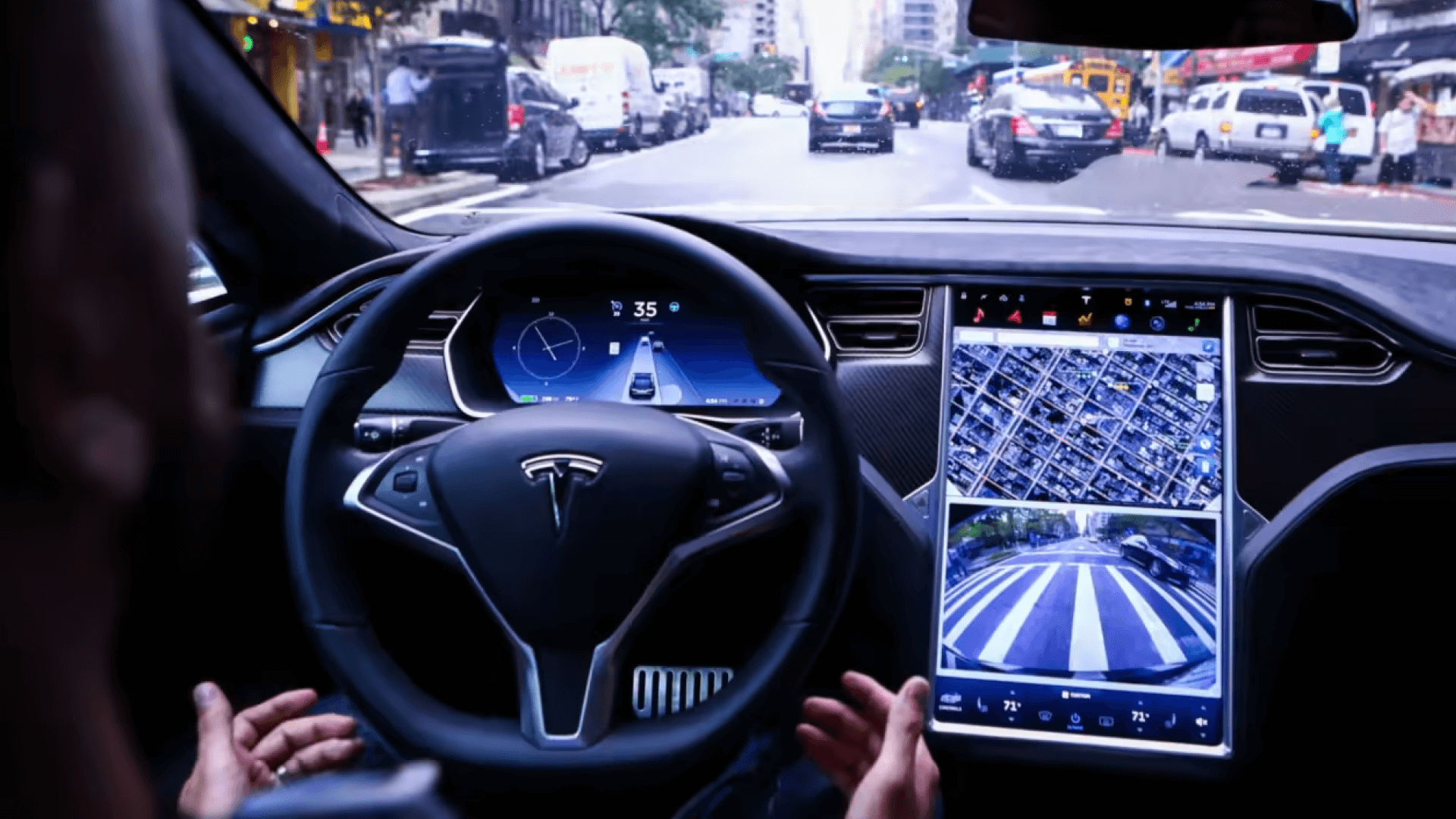

Tesla hits the brakes as stock slows down by 5% 🏎

Tesla is recalling 362,000 vehicles due to a full self-driving software flaw. On Thursday evening, The National Highway Traffic Safety Administration reported the software allows a vehicle to “exceed speed limits or travel unpredictably, increasing the risk of a crash.”

Musk isn’t happy that the word ‘recall’ is being used, as he believes it can be fixed with an ‘over-the-air’ update. Unfortunately for him, it seems the damage is done as the stock is down 5%.

Airbnb jumps 11% thanks to positive earnings 🏡

It was all love for Airbnb as the company announced its first full year of profitability on Valentine’s Day. Thanks to a global travel rebound, Airbnb’s international bookings were up 49% year-on-year. The company has also upped its prices, leading the company to report a net income of $1.9bn, up 24% from last year.

The company also announced it has repurchased $1.5bn in stock in the past five months, which may have helped drive the share price up for two reasons:

1. It shows Airbnb are confident in its own stock, which often helps investor confidence

2. It can increase the stock’s demand, as it leaves fewer shares available for investors outside of Airbnb

Palantir soars 17% after posting first profitable quarter 👨💻

On Monday, the software company announced a net income of $31 million. This is a significant increase from the previous year, as it lost $156 million. Palantir’s CEO, Alex Karp, had originally stated he didn’t expect this level of profitability to come until 2025. He’s said it’s left the company feeling “very, very excited”, and our guess is shareholders are feeling the same way.

What have we learned this week? 🤓

If a company can increase its prices and still receive the same amount of demand, it’s likely to increase profit, potentially leading to better earnings

Earnings season often affects a stock’s price - when a company shows they’re profitable, it gives investors confidence they’ll potentially see a return on their investment

When a company repurchases its own stock, it often drives share price up

Thanks for tucking in! Want to receive these updates every Friday? Sign up here or share via WhatsApp with your friends.

*Figures correct as of Feb 15th 2023.

Past performance does not guarantee future results. Capital at risk when investing.

This content is for educational purposes only. Shares does not provide investment advice. If you are unsure about anything, please seek advice from an authorised financial advisor.