That's right, Scoop is back to help you learn the stuff they didn't teach you in school with 10 of the finest tips for beginner investors.

1. Establish your investing goals

Figure out why you want to invest and then align your goals with your actions. For example, cutting down your retirement age may warrant long-term investing, whilst investing for immediate passive income may involve looking into different investments, centred around paying income on a regular basis.

Like anything, start with the end in mind. Would you go on a run without knowing where you'll finish?

Goals first, actions second!

2. Start small

Investing isn’t about tying up all your cash in stocks and shares as soon as possible. Start with small amounts of money.

The truth is, whether you’re investing £10,000 or £1, the process is the same. Nail the process first by developing a good method of researching stocks and learn which buttons to press on an app.

The last thing you want is to accidentally thumb-tap your way into buying a stock. We’ve all done it on someone’s insta profile, and trust me, it’s much worse when money’s involved.

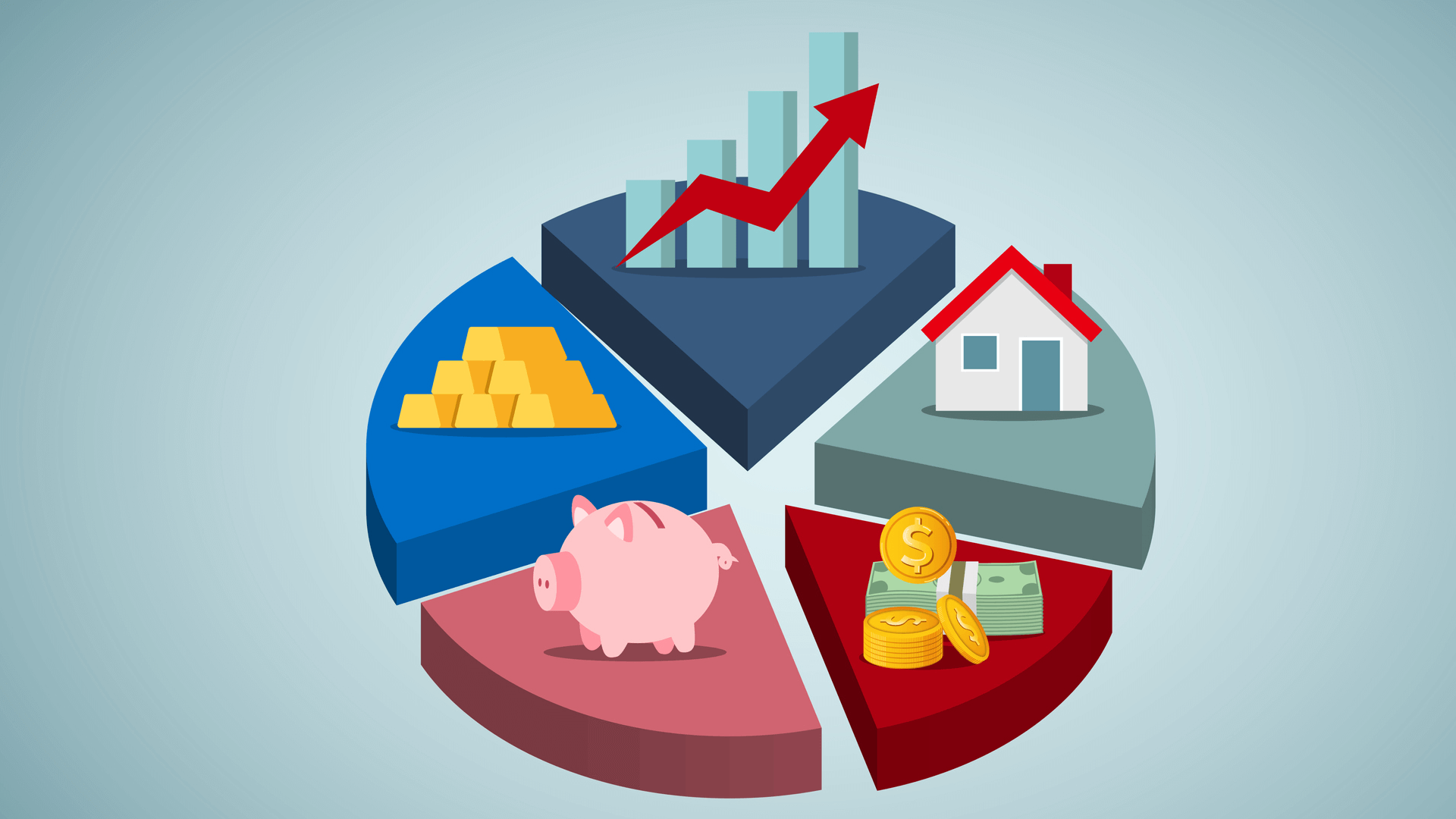

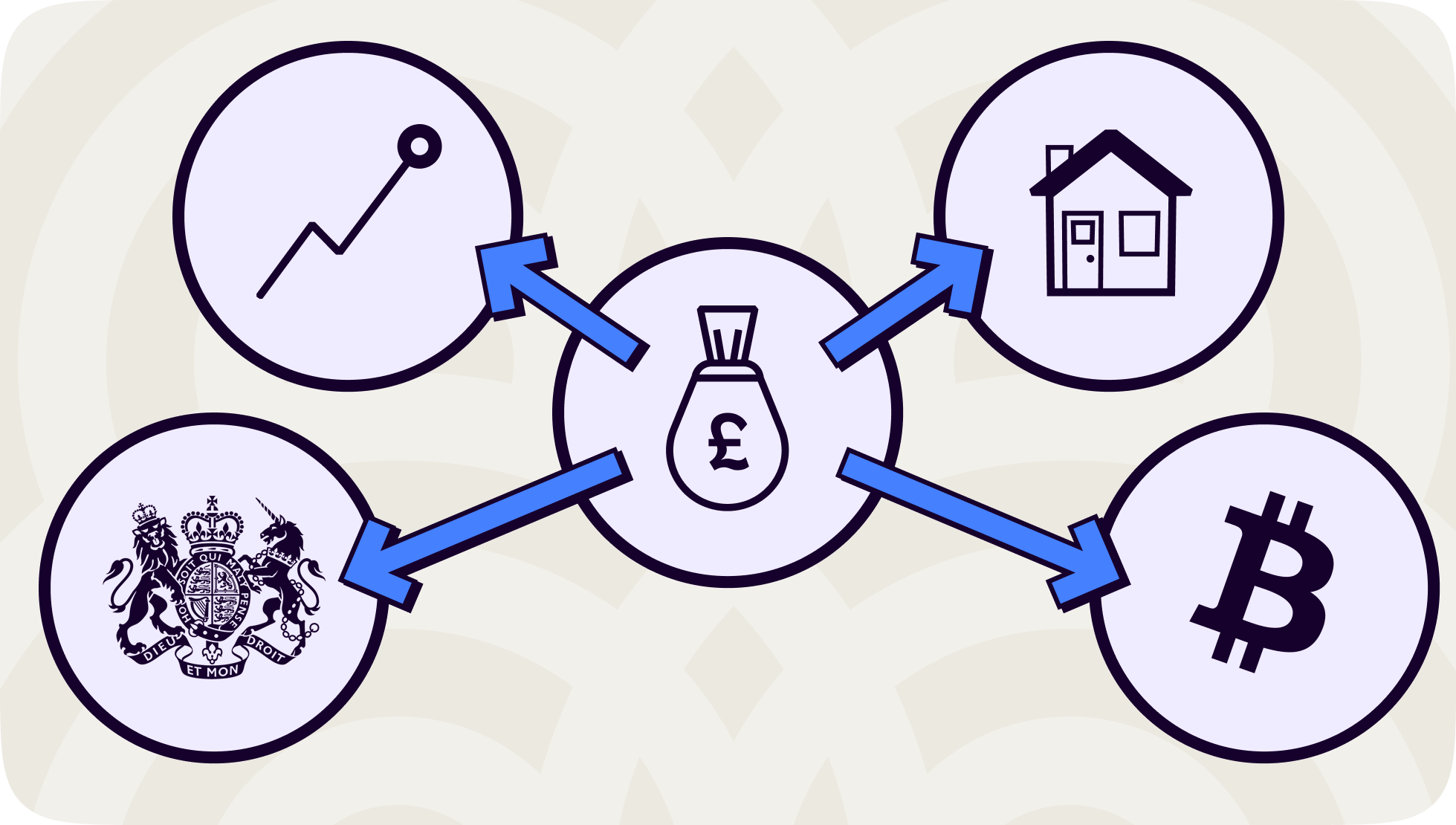

3. Keep diversified

Diversifying is all about not putting all your eggs in one basket.

It involves spreading your investments across different assets (stocks, government bonds, crypto etc) and sectors. An investor big into crypto may also wish to invest in stocks, so they’re more protected should the crypto market collapse. The stocks they pick may be spread across different sectors like healthcare, retail and technology. This makes them less reliant on one industry’s performance!

Diversifying works well for a beginner. As you gain more confidence, there may be specific industries and companies you gravitate towards, and that's okay.

4. Keep cool, calm and collected

Bit of an emotional wreck? Don’t let that put you off investing, just remember, the stock market has ups and downs. When you’re up, think rationally and make an informed decision whether to buy, sell or even do nothing. The same goes for when you are down on your luck.

We've said it twice now, and we'll say it once more for luck. Think back to your investing goals when weighing up what to do!

5. Simple is often best

Investing in an index is a great way to keep things simple – it’s easy to do, keeps you diversified and reduces the need to research individual stocks. An index like the S&P 500 factors in the largest stocks in the U.S. into one investable fund. Keeping things simple doesn’t sacrifice performance either, the S&P has returned around 10% on average during the last 30 years.

If you have little time, but want to start investing, this might be worth considering.

6. Invest only what you’re comfortable losing

The aim of investing is to increase your net worth, right? Well, this isn’t always the case. No one can predict what the markets will do next, and anything invested is subject to risk. You must keep this in mind!

Look at your overall finances and weigh up what you can afford to lose. As mentioned, start small and as you grow in confidence, increase your investments. But never increase them past a point where you’re not comfortable with it all being at risk.

7. Trust in apps

Thankfully, you don't need to visit the London Stock Exchange every week like you would Tesco for the weekly food shop.

Nowadays, almost everything is run through apps. You can literally buy Nike stock sat in your trackies. Keeping this process digital means you can manage everything in one place, just like with online banking. Oh, and not to mention, there's no face-to-face interaction with any stockbrokers to make a fool of yourself in the early days. Lovely.

8. Choose your 'investment asset'

Oh no, ‘investment asset’ sounds a bit buzzwordy. Let's break it down. An asset is a type of investment – stocks, bonds, funds, cryptocurrency and NFTs are all classed as an 'asset type'.

Our tip? Take the time to learn about each asset that interests you. Weigh up how each one aligns with your goals. Want to make long-term, stable investments? Perhaps growth and dividend stocks are for you. Fancy a little more risk and short-term trades? Crypto trading could be the way to go.

9. Think beyond the brand

I see a lot of investor newbies do the same thing when they start. They invest in companies they recognise. Their decision-making stems from their own relationship with a brand. Have an iPhone? I bet you'd be tempted to invest in Apple. Before doing so though, it's wise to look at Apple's balance sheets – how much debt are they in? What's their net profit each year? Where are they investing their money for the future?

We've put together a handy guide on when to buy and sell stocks.

10. Rock, paper, scissors...time?

Rock beats scissors, scissors beats paper, and paper beats rock. But nothing beats time. We're all guilty of saying we're going to do something and not following through. I've got a diet plan from 2018 that I've still not touched.

Time really is on your side when investing though, largely due to compound interest. But, learning this stuff now will make decision-making easier for you further down the line.

Starting with investing now doesn't necessarily mean putting your money where your mouth is. Begin with learning and researching, just as you are now!

An investment in knowledge pays the best interest

In need of some other beginner guides to do with investing? Make sure to check out:

For more beginner tips, download the Shares app and join the beginner investing community! Make sure to follow us on our socials 👇

As with all investing, your capital is at risk.

Shares is a trading name of Shares App Ltd. Shares App Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority.