TL;DR

Stocks and shares allow investors to receive part ownership of a company

‘Stocks’ is the more generic term, whilst ‘shares’ refers to ownership of a specific company

Public and private shares exist – public are available to everyone, whilst private aren't

One major advantage of stocks is the possibility of making money through 'capital gains' or 'dividends'

A serious disadvantage of stocks is that they come with risk and profit is by no means guaranteed

Simply put, stocks and shares are something a person can buy, and in return they receive part ownership of a company.

Typically, the company takes this cash and invests it back into their business, hoping it’ll help them grow. Should the business become more successful, it’s likely the investor's shares will increase in price. A ‘win win’ for all involved.

Of course, it doesn't always go according to plan. There are many risks with stocks and shares which we shall come onto later.

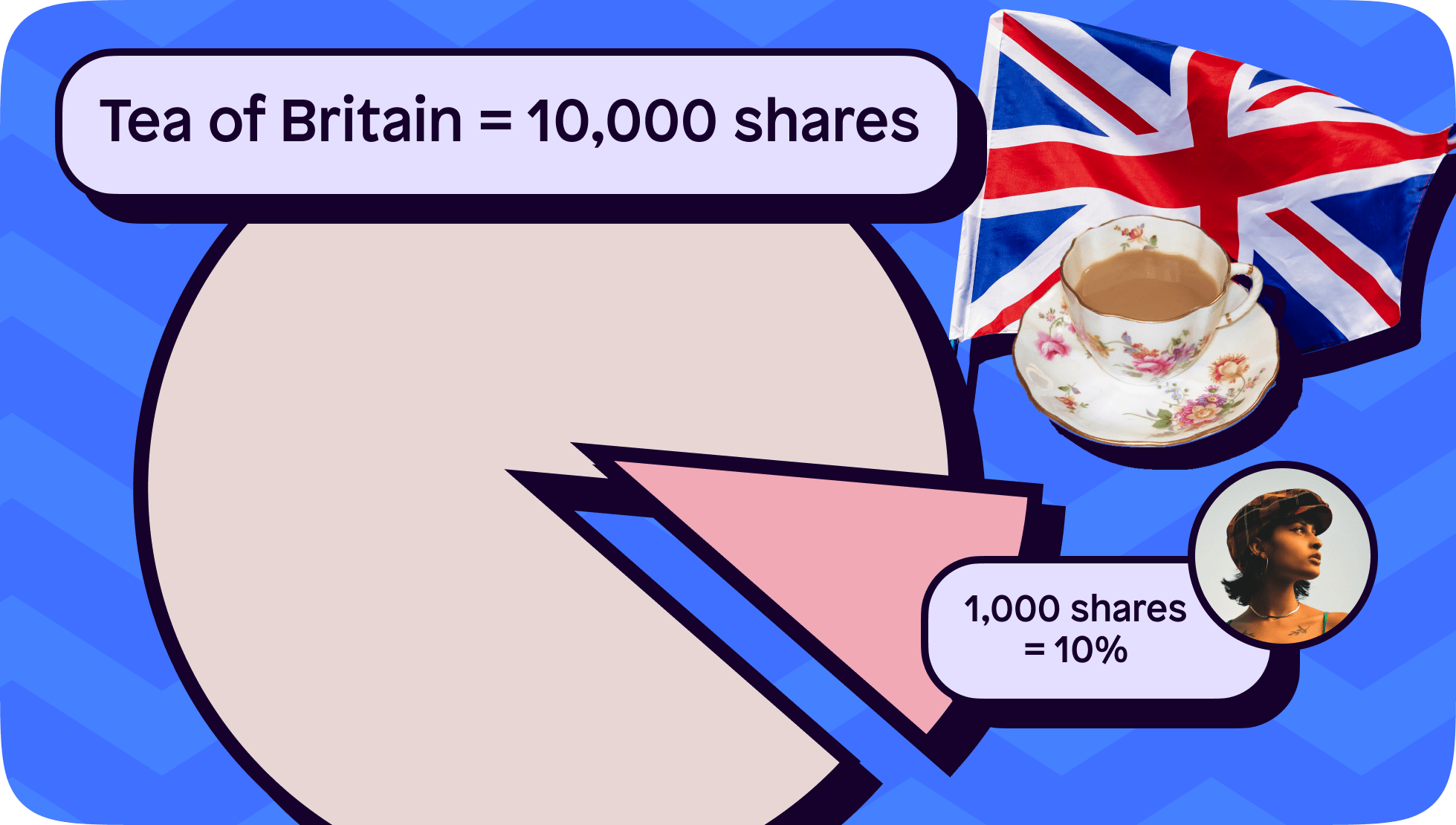

For now though, let's pretend a company called 'Tea of Britain' has 10,000 shares.

Each share represents 1/10,000 worth of ownership in Tea of Britain. That means if Alice owned 1,000 shares, she'd own 1,000/10,000 of the company. Fractions become confusing, especially when we’re dealing with larger numbers. That’s why we use percentages.

So, 1,000 is 10% of 10,000 meaning Alice owns 10% of the company. You with me?

Now, if each share costs £200, it might be a bit steep for a first time investor. That’s where fractional shares come in handy, which allow investors to buy part of a share, such as 0.1. A fraction of a share, for a fraction of the price. Clever!

The Shares app does offer fractional shares, but make sure to read our full guide on what they are, as well as their pros and cons.

What’s the difference between stocks and shares?

The terms 'stocks' and 'shares' are often used interchangeably, but what is the real difference?

It all comes down to if you’re describing ownership of a specific company, or numerous companies.

‘Stocks’ is a more generic term, and is used when talking about ownership in one or several companies. ‘Shares’ is used to describe ownership of a specific company.

For example:

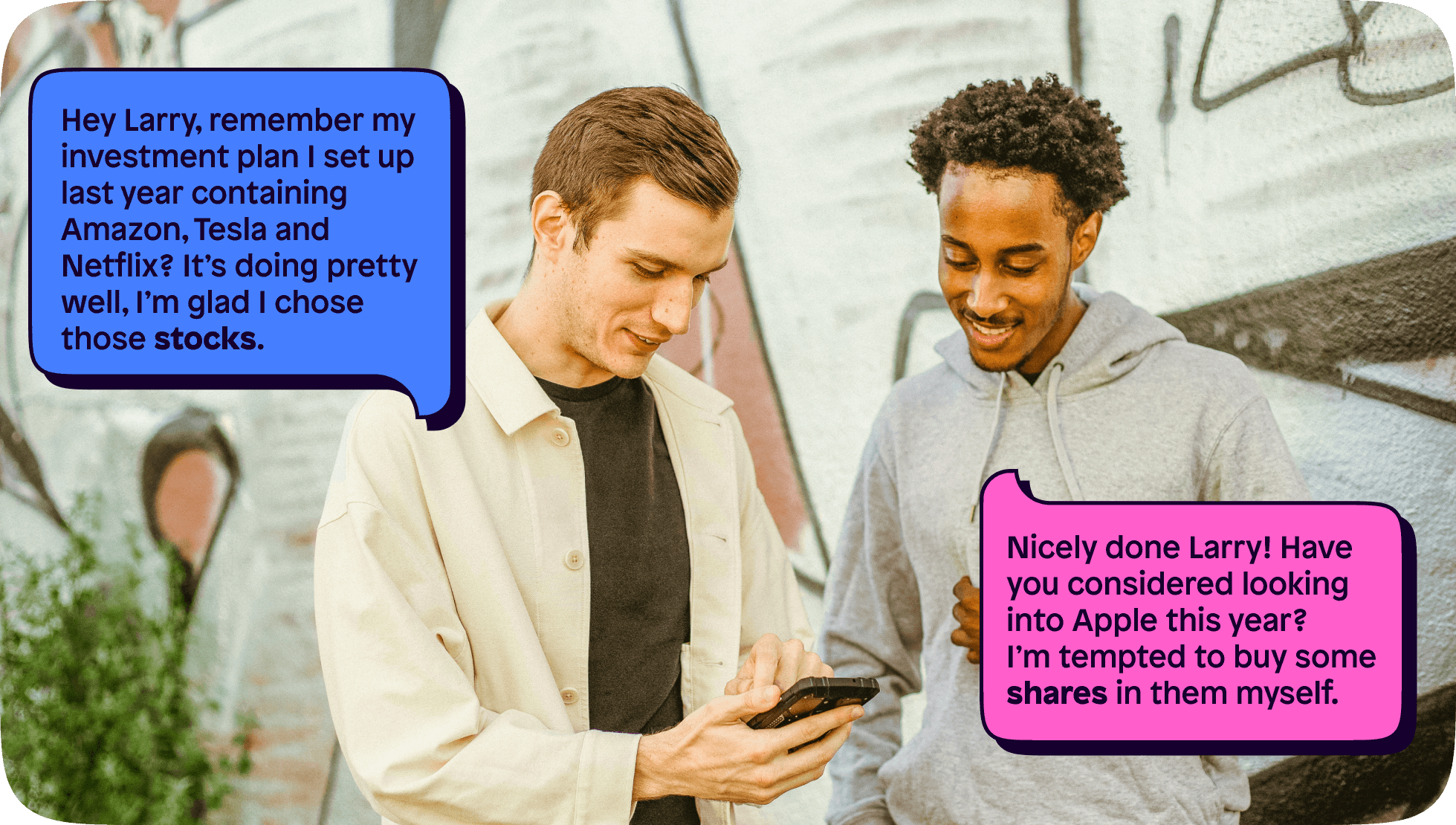

“Hey Larry, remember my investment plan I set up last year containing Amazon, Tesla and Netflix? It’s doing pretty well, I’m glad I chose those stocks”.

“Nicely done Larry! Have you considered looking into Apple this year? I’m tempted to buy some shares in them myself.”

Public vs private shares

Both public and private shares can be bought, but there’s one key difference.

Public shares

As the name suggests, these shares are open to everyone. You, me and even my noisy neighbour can all buy shares in a public company using a trading app or broker, should we wish.

Private shares

Private shares are much harder to buy. Often, private companies will approach certain individuals with a high net worth and an extensive contact list to help with business growth. These business titans are known as 'angel investors'.

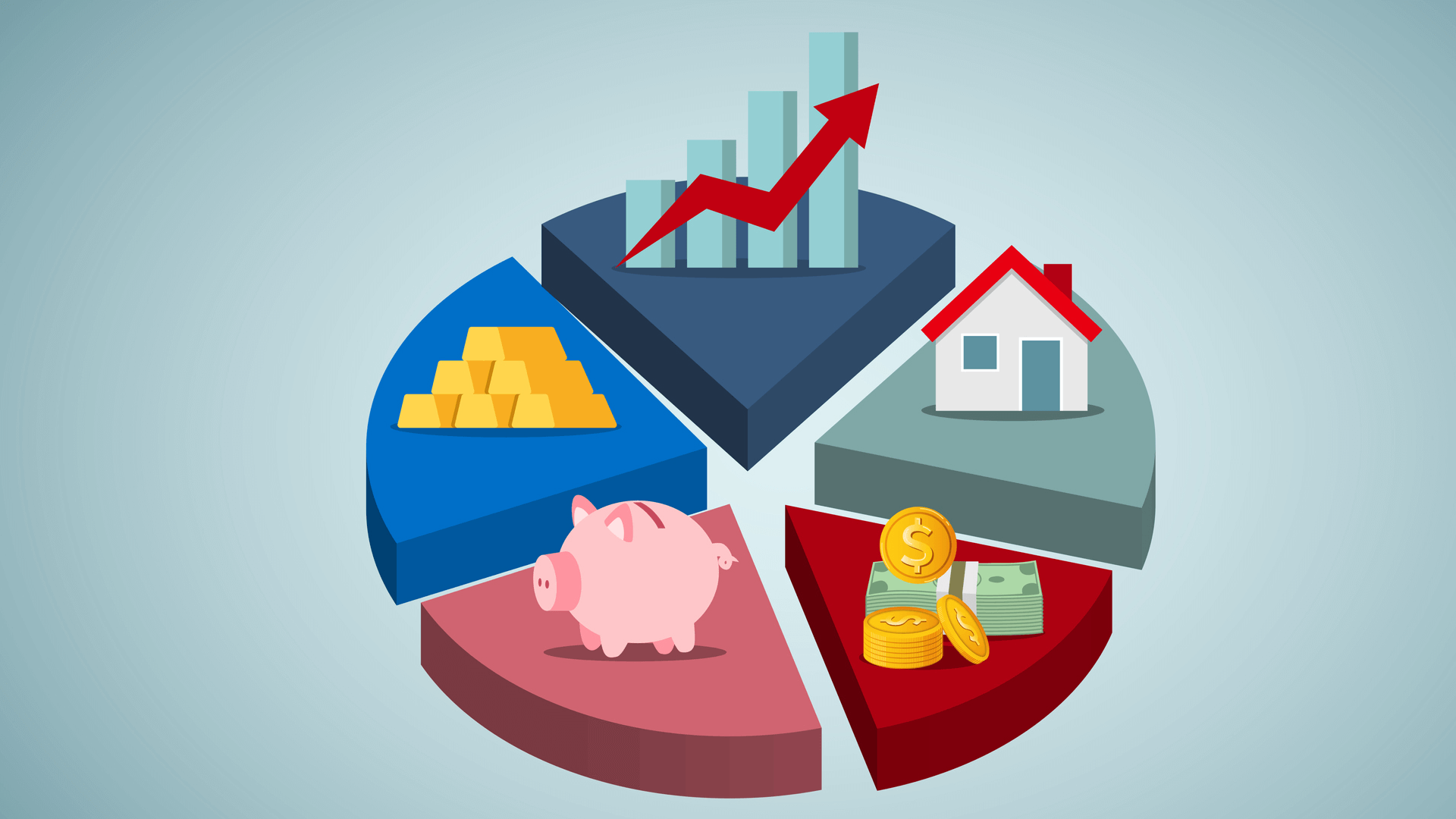

Advantages and disadvantages of stocks and shares

Whilst many investors have received healthy returns from the stock market, it does come with risk. There is always a chance you can lose what you invest, and so being aware of the disadvantages of stocks and shares is just as important as the advantages.

Let’s take a look at both:

Advantages of stocks and shares

1️⃣ Capital gains – buying low and selling high is the name of the game when it comes to capital gains. It’s often the first way people think of making money with stocks, and happens when a stock’s price exceeds the price it was bought for.

2️⃣ Dividend income – dividend stocks pay the investor for simply owning their stock. Many investors favour these as it allows them to earn passive income, whilst still being invested in the market.

3️⃣ Tax advantages – both capital gains and dividend income are taxed at a lower rate than employment income.

4️⃣ Convenient – compared to something like property, the barrier to entry for investing in stocks is quite low as they’re quicker and often more straightforward to buy. They also only require £1 to get started, and whilst the same can be said for cryptocurrency, crypto is a more complex asset class to understand.

Disadvantages of stocks and shares

1️⃣ No guarantee of profit – no one can predict a stock’s next move. Whilst they’re bought with the intention to generate profit, plenty of people have lost money when investing in stocks. Even if a business has made all the right decisions, factors outside their control can still affect earnings. For more info on what macro risk factors are, visit our article on ‘what is the stock market?’

2️⃣ It takes time – building a profitable portfolio doesn’t happen overnight. This will take time, unless you’re in the game of trading, which is naturally quite risky. Investing in stocks is a long-term play.

3️⃣ Time-consuming – not only do stocks take time to profit from, they can also consume your time. Understanding how stocks work, researching them and learning how to buy them isn’t a half hour job!

4️⃣ Emotional ups and downs – with investing, it’s essential to be realistic. There will be ups and downs, and if handling emotions isn’t your strong point, you may want to reconsider the world of stocks and shares.

Can you have more than one stocks and shares ISA?

Yes, you can have more than one stocks and shares ISA. There’s no limit the amount of ISAs you can have, but you can only pay into one each year.

Make sure to read about other investment assets such as:

Download the Shares app and make sure to follow us on our socials 👇

As with all investing, your capital is at risk.

Shares is a trading name of Shares App Ltd. Shares App Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority.