Yep, with ethical investing you really can have your organically produced cake and eat it.

TL;DR

Ethical investing is about investing in companies for moral and financial reasons

The industry is more popular than ever, now valued at $17 trillion 🤯

Ethics isn't just about the environment – there are lots of other examples

Investing ethically requires two steps – knowing your own beliefs and creating an ethical portfolio

The future of ethical investing looks bright thanks to Gen Z

Definition of ethical investing

So, what is it?

Ethical investing is a strategy.

A person may invest in public companies that align with their own personal beliefs, whilst also aiming to make a return on their investment – the desire to do good and earn profit go hand-in-hand. For this reason, ethical investing shouldn't be confused with charitable donations.

The ethical investing industry has skyrocketed in recent years, and is now worth over $17 trillion. Much of this is due to Gen Z, who strongly believe in positively impacting the world, whilst also taking their finances into their own hands.

Good on you Gen Z, I salute you.

Examples of ethical investing values

Ethics is a personal matter, and what one person deems ethical may vary to somebody else.

Contrary to popular belief, ethical investing isn't just about investing to protect the environment. Whilst climate change is a major aspect, there are other examples:

Social values – investing in companies that benefit specific societal groups, such as people who are homeless.

Moral values – investing or avoiding industries that do or don’t align with a person's moral values. For example, believing in the banning of smoking and avoiding the tobacco industry.

Religious values – each religion has their own value and belief system. People may invest in businesses with values that align with theirs.

Political values – politics and business are closely linked. Investors often feel more comfortable investing in a company that aligns with their own political agenda.

Green values – assessing how impactful a company is on our environment before investing.

Types of ethical investing

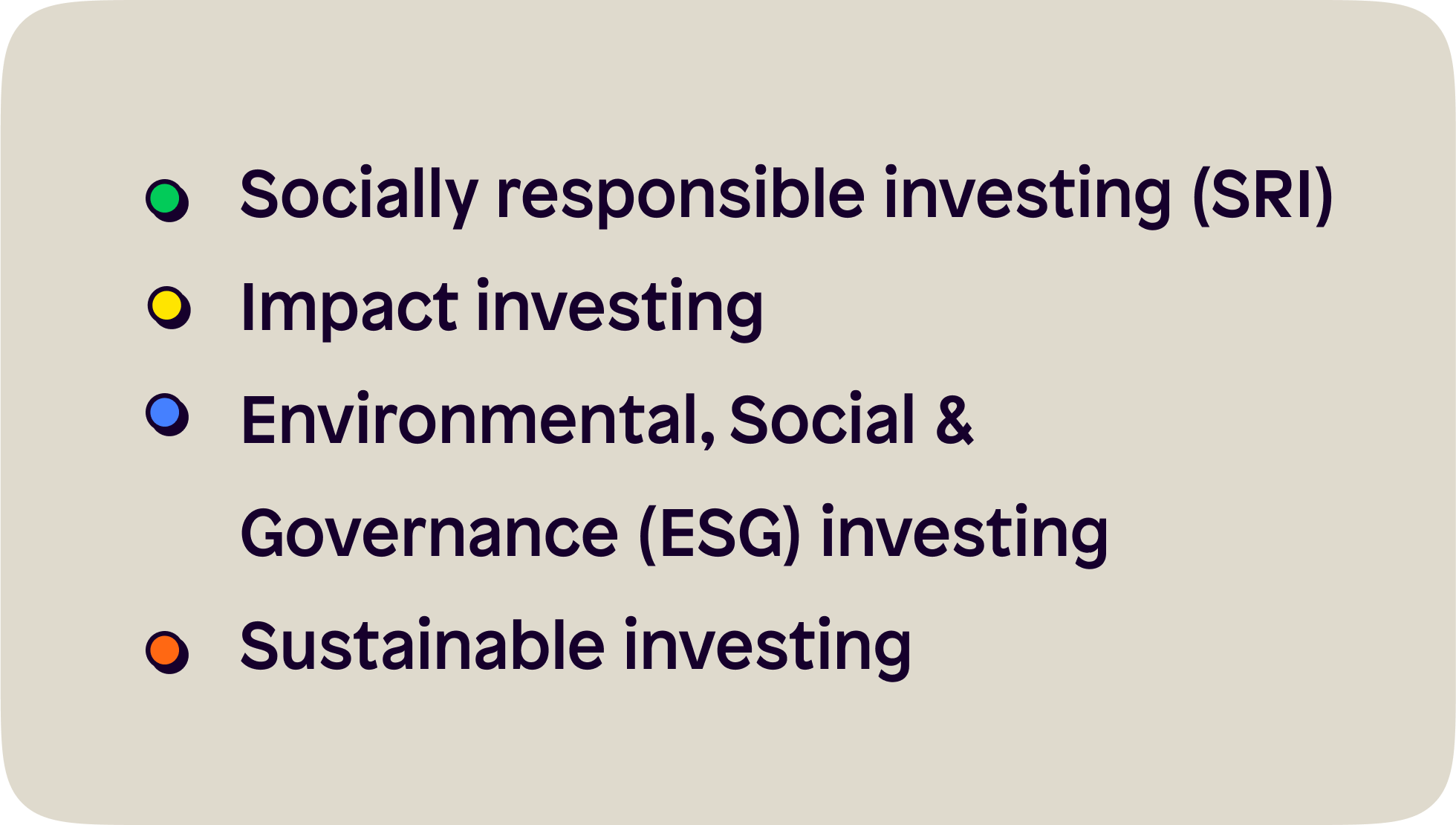

There are a few terms that sit under the umbrella of ethical investing. These are:

Socially responsible investing (SRI)

Impact investing

Environmental, Social & Governance (ESG) investing

Sustainable investing

It’s not crucial to understand the exact differences between these. The bottom line is ethical investing is about choosing investments that have a positive impact on the world.

Having said that, the more you look into ethical investing, the more you’ll see these terms bandied about. So let's take a look:

Socially responsible investing (SRI)

Socially responsible investing is when you actively avoid companies that you don't agree with – common examples are tobacco and alcohol companies.

Impact investing

Whilst SRI is about avoidance, impact investing is all about investing in companies that are doing that – having a positive impact. For example, someone might invest into a business that creates clean energy.

So to recap:

❌ Socially responsible investing (SRI) avoids unethical companies.

✅ Impact investing encourages investment into ethical companies.

Environmental, social and governance factors (ESG)

ESG is the ‘go-to’ measurement when assessing how ethical a company is.

It stands for Environmental, Social and Governance. It measures a company’s impact on the environment, its impact on society and how it’s run (its governance).

Environmental

This focuses on how a company reduces their negative impact on the environment by looking at the business model behind their products/services. For example, a clothing company might rank higher in this category if they make t-shirts out of 100% recycled materials.

Other examples include using renewable energy sources to become a net-zero business, switching to zero-waste products/ sustainable packaging and ensuring recycling takes place at all times.

Social

The social aspect of ESG focuses on how a business impacts society.

Let's stick with the t-shirt example above. Although it has been produced from recycled materials, what if it used sweatshops to create them? Sweatshops may not damage the environment, but creating unfair working conditions is not socially ethical.

Governance

Governance refers to the processes of decision-making, reporting and how a business operates.

How honest are seniors at the business with stakeholders about their activities? Are they misleading investors? Lying to employees? How diverse is the company’s board, and how much do they get paid?

These can all factor into how ethical a company’s governance is.

Sustainable investing

Sustainable investing is about investing in companies that are solving the world’s biggest challenges. It is about pioneering a new and improved way of operating and often involves 'breaking the mould'.

Whilst Tesla's hefty investment into Bitcoin may not have been positive for the environment (due to the heavy amount of energy Bitcoin uses), its vision to create a planet using electric vehicles is more sustainable than using fossil fuels like oil.

Ethics isn't black and white. It's possible for a company to be on completely different ends of the spectrum within different aspects of ethics. It's why we struggle to categorise which companies are truly ethical. So how do you invest ethically then? Well, that takes us nicely onto our next point...

How to invest ethically

There are two simple steps to get started with your ethical investment journey.

1. Understand your beliefs

Remember, with ethical investing, it isn't a 'one size fits all' approach. What you deem as ethical will likely differ to someone else – and that's okay.

Let's use Sarah as an example.

She is passionate about women in roles of leadership but enjoys gambling at the weekends. As part of her strategy, she may focus her stocks on companies run by women. This isn't to say she'd stop investing in companies that promote gambling. Gender equality and gambling are both aspects of ethical investing, but Sarah 'impact invests' into women led companies.

Sarah's friend, Clare, disagrees with the gambling industry. She may avoid gambling companies as part of her strategy.

So, what is important to you? Grab a pen and paper, start writing them down and move onto step 2!

2. Build an ethical portfolio

Research, act and watch out for greenwashing!

Research

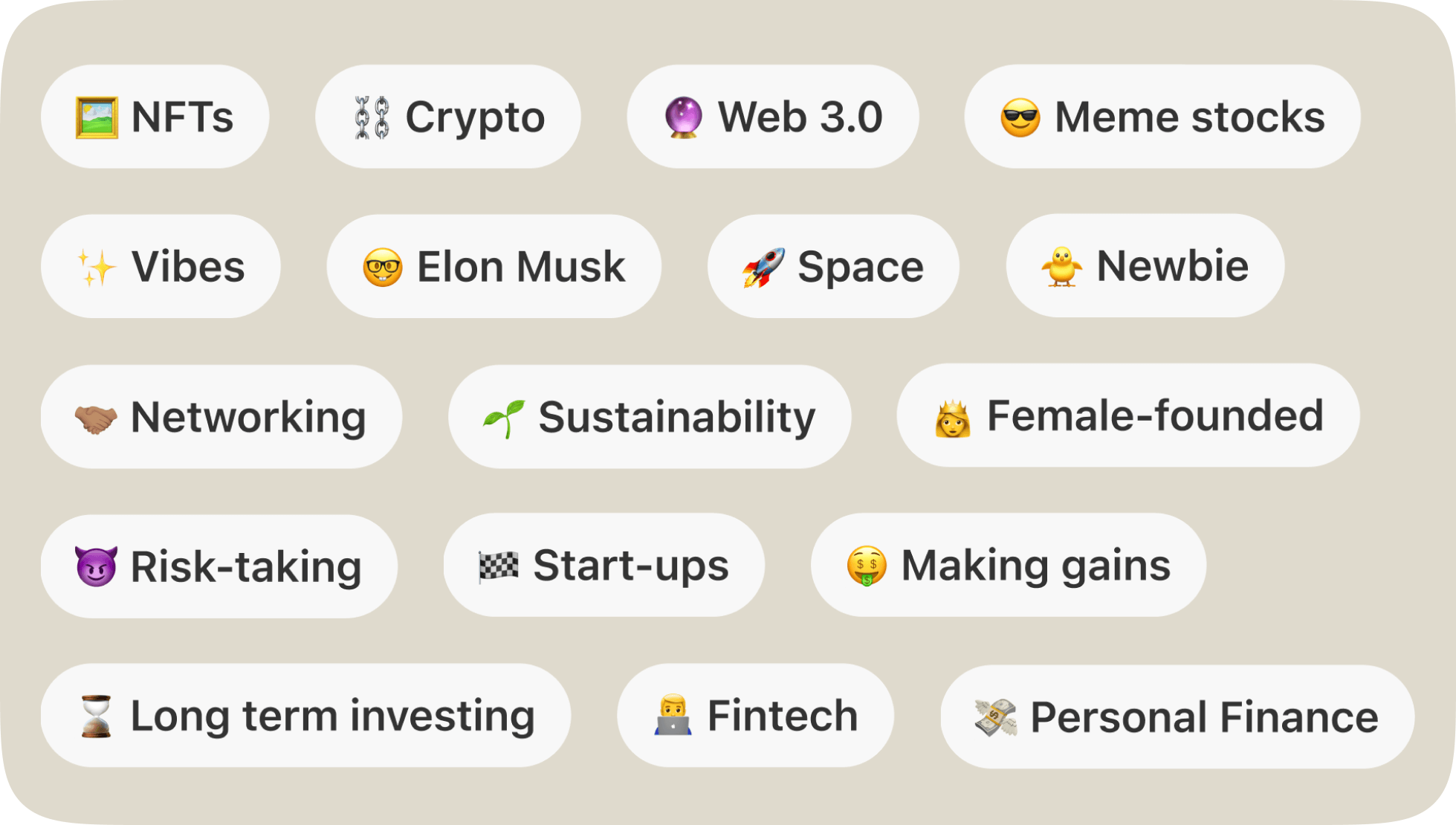

To make things easy, we have sections in our app dedicated to specific stocks. From female CEOs to renewable energy, you can find a list of companies to suit your cause.

Start researching these stocks. Here are two resources you can get started with:

MSCI - search a company and view their ESG rating, carbon emission and climate impact.

PRI - find ethical companies and resources.

Act

Once you have your list of companies, it’s time to act. Assess risk, time and expected profit in relation to your own goals.

Risk - as with all investing, can you afford to lose what you put in?

Time - think back to your financial goals. How long do you want to keep your money invested? If you're young and thinking long-term, can you afford to take on more risk early on?

Expected profit - be realistic. What are you hoping to get out of these investments? Is this a 'rainy day' fund or is this a plan towards a property or pension?

If investing ethically is something you want to do over the long-term, dollar-cost averaging each week/ month might be a smart move. Calculate how much you wish to invest using a take home pay calculator and set a reminder.

Greenwashing

Lastly, look out for greenwashing.

Companies will spin their ethical activities into marketing campaigns to help boost their PR. When this is done with an effort to persuade the public that they are ethical, we call it greenwashing.

Remember, ethical practice should be carried out for the sake of being ethical, not in order to raise company profits!

The future of ethical investing looks bright

Bloomberg conducted a survey asking Gen Z about ethical investing in 2021. Their findings? The industry is poised for growth.

46% of the 'Gen Zers' made personal financial investments in 2020

51% said green and sustainable investing has the biggest investment potential in 2021. 23% chose technology, 13% chose healthcare and 8% chose cryptocurrency.

45% of the respondents said investing is important ‘for a better tomorrow’; while 25% said they are investing to feel financially secure and 19% were aiming to increase their wealth.

40% said the main driver for their investment decisions was ‘companies with a purpose’; this was almost double the amount of people who saw technology as the key driver.

75% invested in stocks, 7% invested in bonds, 7% in Bitcoin and the remaining 10% in other assets.

Tech stocks have boomed in the last 20 years, but is ethical investing set to steal the crown? Perhaps! As with all things investing, time will certainly tell.

For more beginner guides, make sure to check out our following blog posts:

Let us know your thoughts by download the Shares app and make sure to follow us on our socials 👇

As with all investing, your capital is at risk.

Shares is a trading name of Shares App Ltd. Shares App Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority.