As a defensive investor, you opt for less volatile investments that don't tend to fluctuate, with an aim to preserve your capital whilst generating steady, yet reliable returns over the long-term.

It's a bit like being a defender in football. Sure, you want to score, but your main aim is to keep the ball out of your own net, and the way you play the match is orientated around this strategy - safety is the priority.

So, we know what defensive investing is. But how do you invest this way? Before diving in, make sure you’re familiar with how to invest. Check out our article on how to invest in stocks.

All clued-up? Great. Here are 5 ways to adopt a defensive investing strategy.

1. Invest in blue-chip stocks

Blue-chip stocks are large, well-established companies.

They have a strong track record of stability and financial performances. Often, they are market leaders and aim to preserve their position at the top of their industry, typically meaning they take less risk than smaller, and more speculative companies, trying to enter the market.

Should a blue-chip company take on risk, and fail, often they have the cash to survive which is what attracts defensive investors. Many blue-chip stocks exist within the S&P 500 and the FTSE 100.

2. Diversify, diversify, diversify

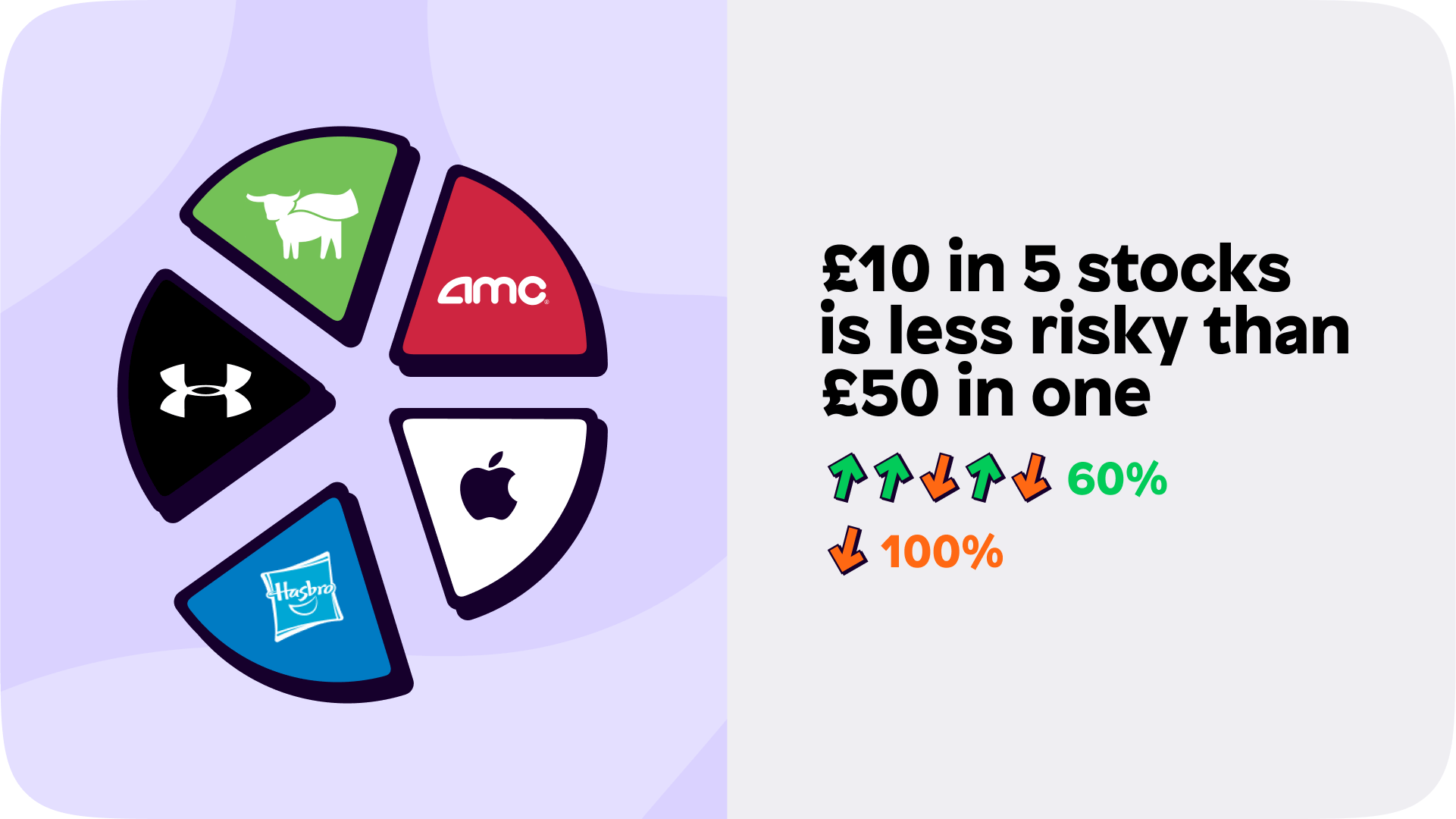

A second approach to investing 'defensively' is to diversify your portfolio by including a range of investing assets like stocks, bonds, ETFs and mutual funds.

Diversifying helps reduce the risk of losing money by spreading it out across a range of investments. If a section of your portfolio makes a loss, another part may make a gain, offsetting the loss. Think of the old adage - don't put all your eggs in one basket.

3. Invest in companies with well-established finances

Although this is similar to the blue-chip strategy, this method also considers smaller companies and dividend oriented companies, too.

Businesses that have a history of strong balance sheets are a defensive investor's dream. Typically, these companies are less likely to go bankrupt and are better equipped to weather the storms of a bear market.

4. Make non-cyclical investments

When we say 'non-cyclical', we're referring to industries or companies that tend to perform well during difficult economic times, like a pandemic or recession. Often, it's the businesses producing essentials such as utilities, healthcare and consumer staples that remain performing well, as these are the last items we'd choose to neglect.

5. Invest in low volatility

If you haven't caught the drift yet, each of the 4 points prior to this have one thing in common - they aim to invest in low volatility.

It might sound counterproductive to invest in low volatility - the whole reason to invest is to grow your wealth and not be a sucker to inflation, right? That's true, but take on too much risk, and you could end up with less capital than you started with.

The truth is, whenever making a defensive investment you should focus on volatility. Understand why the investment you're making is more likely to be steady and stable.

What are defensive stocks?

The term ‘defensive stocks’ simply specifies stocks that fit the defensive investing strategy.

The following stocks are considered defensive by some investors:

Procter & Gamble

Johnson & Johnson

Philip Morris International

Why these stocks? Well, they fit the criteria of being blue-chip stocks, possess strong financial statements, are non-cyclical and pay dividends. These combined reasons help them maintain a low volatility within the stock market.

Disadvantages of defensive investing

Defensive investing isn't a sure-fire investment strategy. Just like with all investing, your capital is at risk.

It can also be more difficult to achieve significant growth with defensive investing, as the focus is on preserving capital rather than seeking out high returns. For this reason, defensive investments may underperform in a bull market, when the overall market is experiencing strong growth.

Like with all things in investing, it depends on your own situation whether defensive investing is for you.

Your risk appetite, financial goals, pensions and other aspects are all things to consider. We talk more about these in our article, are you ready to invest?

Those who are approaching retirement and want to protect their hard-earned savings may be more inclined to invest defensively. Regardless of your situation though, if you aren't sure on how to start investing, make sure to carry out diligent research, or talk to a financial professional.

Let us know what you think about defensive investing in one of our communities on the Shares app! Make sure to follow us on our socials 👇

As with all investing, your capital is at risk.

Shares is a trading name of Shares App Ltd. Shares App Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority.